Selected Offering Exemptions

August 1, 2016 | By Vela Wood

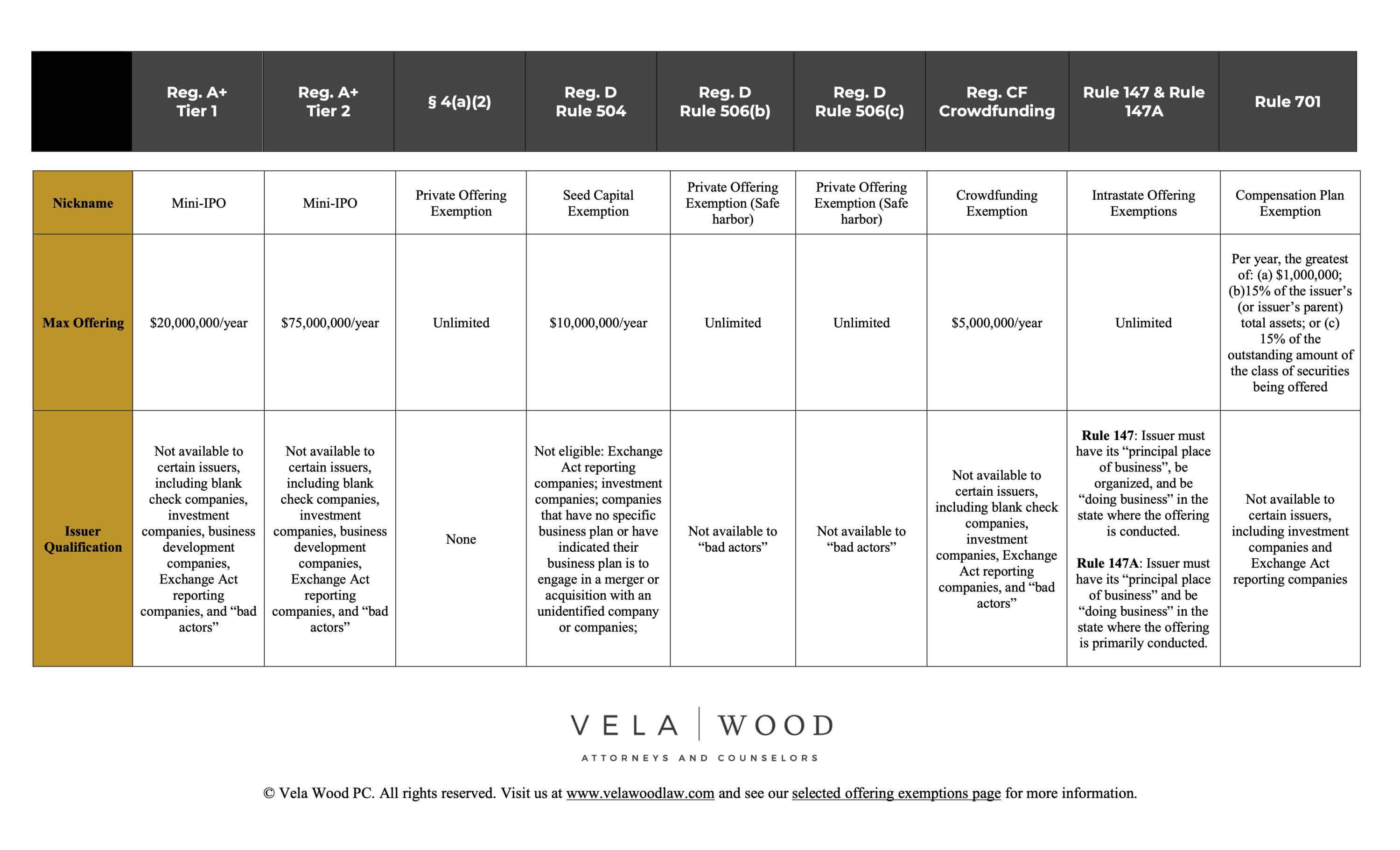

Quick Guide to Offering Exemptions

Click here to view and download this easy to navigate PDF identifying some of the requirements, limitations, and advantages of a few federal exemptions available to small businesses raising capital.

Updated February 2023 Please note that the information below is only informative in nature, is subject to change, and shall not be construed as offering legal advice in any way. You are solely responsible for your use of the information below. Please consult with an attorney for specific application of any exemption.

Determining the most suitable exemption will depend on the particular needs of your business and the structure of your offering. (Note, that each and every time your company conducts a raise, the securities must qualify for an exemption or be registered under federal and state law.) A few factors to consider include: how much money you’re looking to raise, what type of investors you wish to reach, and how you plan to conduct your offering. A more detailed explanation of the basic breakdown covered in the chart above follows, and is separated by a few of the critical distinguishing factors.

Note, the exemptions discussed below and in the chart exempt issuers from the registration requirements of the Securities Act of 1933 (the “Securities Act”); however, issuers are still subject to other provisions of the Securities Act, such as the antifraud provisions.

Exemptions Overview

Regulation A

Although not exhaustive, this chart provides an overview of some of the more popular federal registration exemptions available to issuers. Regulation A (“Reg A”) allows small and medium-sized companies to raise large amounts of capital without the burden of full Securities and Exchange Commission (“SEC”) registration. Considered a “mini-IPO,” Reg A essentially exempts public offerings conducted by private companies. Reg A, referred to as Regulation A+ (“Reg A+”) after the amendments mandated by Title IV of the JOBS Act, provides for two tiers of offerings, Tier 1 and Tier 2 (collectively, the “Tiers”), each containing different qualification requirements. For more information on the Reg A Tiers, read our blog, Regulation A+: Good News for Non-Accredited Investors.

Regulation D

Regulation D (“Reg D”) provides exemptions for smaller, private offerings. Rule 504 of Regulation D, sometimes referred to as the “seed capital exemption,” is favorable for companies conducting their initial funding round(s). Rule 506 of Reg D is a safe harbor for the private offering exemption of Section 4(a)(2) of the Securities Act (“§ 4(a)(2)”). Rule 506 exempts two types of offerings: Rule 506(b) and Rule 506(c), differentiated primarily by the ability of the issuer to use general solicitation or advertising in a 506(c) offering. For more about general solicitation, read our blog, How Lifting the Solicitation Ban Benefits Startups.

Reg D also created a Rule 505 exemption; however, Rule 505 has been repealed by the SEC, effective May 22, 2017. Rule 505 limited the maximum offering amount to $5,000,000, allowed for an unlimited number of accredited investors and up to 35 non-accredited investors, and required disclosure documents similar to those in a Rule 506(b) offering, discussed below. By rule dated October 26, 2016, the SEC increased the maximum offering amount in Rule 504 to $5,000,000, thereby largely eliminating the need for Rule 505. To read more about the changes to Reg D, check out our blog, Out With the Old (Rule 505), In With the New (Rule 504) .

Regulation CF

Regulation Crowdfunding (“Reg CF”), adopted pursuant to Title III of the JOBS Act, exempts capital raises conducted through online crowdfunding platforms. As well as establishing guidelines for the issuers, Reg CF also regulates the funding portals and broker-dealers that facilitate the crowdfunding offering. Check out more of our blogs on crowdfunding here.

Rules 147

Rules 147 and 147A, the “intrastate offering exemptions” (collectively, the “Rules 147”) provide an exemption for a company raising money solely from investors located within its home state. Rule 147 is a safe harbor for Section 3(a)(11) of the Securities Act and imposes certain requirements on the issuer to ensure that the company, the investors, and any resales of the securities, are located in-state. Rule 147A is nearly identical to Rule 147 except that it permits offers to reach out-of-state residents and issuers to be incorporated or organized out-of-state. Find out more about the rules and requirements for the intrastate offering exemptions on our blog, Keeping it Local—Changes to the Rule 147 Intrastate Offering Exemption.

Rule 701

Rule 701 exempts securities granted pursuant to an employee benefit plan or other similar compensatory arrangement. This exemption allows private companies to sell securities as compensation to their employees, officers, directors, partners, trustees, consultants, and advisers without the need to file a registration statement with the SEC.

Blue Sky

Note that even though you may qualify for one, or several, of the federal exemptions listed above, you may still be subject to registration under state securities laws (known as “blue sky” laws). Likewise, just because a federal exemption may not require certain disclosures or investor verification, for example, a corresponding state law may still require it. Therefore, it’s important that you talk to an attorney prior to the start of your raise to determine what exemptions, if any, you can claim under state law. To learn more about blue sky laws, read our blog, Why you Need to Consider Blue Sky Laws Before Conducting a Capital Raise.

Maximum Offering Amount

In deciding which exemption is right for you, one of the first things you’ll need to consider is how much money you’re looking to raise. Section 4(a)(2), Rule 506, and Rules 147 permit an unlimited amount of money to be raised, while the other exemptions set various limits on the total amount of the offering. Tier 1 and Tier 2 of Reg A+ are each subject to a different set of max offering rules: Tier 1 caps offerings at $20 million in a 12-month period and the enhanced regulatory requirements of Tier 2 allow for offerings up to $75 million every 12 months. Rule 701 limits the amount of securities that may be sold to the greater of: (a) $1,000,000, (b) 15% of the total assets of the issuer (or of the issuer’s parent if the issuer is a wholly-owned subsidiary and the parent guarantees the securities offered); or (c) 15% of the total outstanding amount of the class of securities being offered.

The remaining exemptions set far lower limits on max offering amounts. The new Rule 504 provides an exemption for the offer and sale of securities up to $10,000,000 in a 12-month period, and Reg CF sets the yearly limit at $5,000,000 (adjusted for inflation). It’s easy to see how the needs of a particular company could preclude or open up certain exemptions based on monetary needs and maximum offering limits.

Issuer Qualification

Some of the regulations disqualify certain issuers from using the exemption. For example, the Reg A+, Rule 504, Reg CF, and Rule 701 exemptions are not available to certain investment companies or companies subject to Exchange Act reporting requirements (i.e. public companies). Reg A+, Rule 504, Rule 506, and Reg CF disqualify felons and other “bad actors”: An issuer seeking reliance on either of these rules must determine whether the issuer (or any of its covered persons) is disqualified by prohibited behavior. Additionally, as previously noted, a company that is incorporated or organized outside the state in which the offering is being conducted is disqualified from using the Rule 147 exemption. Please seek advice from experienced counsel before endeavoring to use any of these exemptions.

Investor Types

Another key consideration for determining applicable exemptions are the types of potential investors the issuer may solicit. The regulations separate investors into two basic categories based on annual income/revenue, net worth/total assets, and sophistication: accredited investors and non-accredited investors. The phrase “accredited investor” encompasses a variety of forms (e.g. entities, trusts, enterprises, and individuals). The statutory definition of an accredited investor can be accessed at the following link: Accredited Investor. For a natural person, an accredited investor is one whose net worth, or joint net worth with that person’s spouse, is greater than $1,000,000 (not including primary residence), or who had an individual income of at least $200,000 ($300,000 joint income) in each of the two most recent years and has a reasonable expectation of reaching the same income level in the current year.

Several of the exemptions limit the types of investors that may participate in the offering. Tier 1 of Reg A+, § 4(a)(2), Rule 504, and Reg CF allow practically anyone to invest, but the others set a variety of limits. Tier 2 permits both accredited and non-accredited investors, but non-accredited investors are subject to limits on their individual investment amounts. Rule 506(b) is increasingly restrictive in allowing an unlimited number of accredited investors, but a max of 35 non-accredited investors, as well as requiring all non-accredited investors to meet specific sophistication standards (discussed below in Investor Education Requirement). Rule 506(c) is limited to offerings available to accredited investors only. Rules 147 have no limit on the number of non-accredited investors, however all investors must be residents of the state in which the offering is conducted. Likewise, Rule 701 is available only to certain employees, general partners, trustees, officers, or bona fide consultants and advisers of the issuer.

Individual Investment Limit

Although the majority of the listed exemptions do not set limits on the amount individual investors may invest, Tier 2 and Reg CF set personal investment limits. Non-accredited investors in a Tier 2 offering may only invest up to 10% of the greater of their net worth or annual income (or annual revenue and net assets for non-natural persons). Investors participating in Reg CF offerings are similarly limited by their net worth and annual income. If the investor’s annual income or net worth is less than $124,000, the investor can invest up to the greater of (a) 5% of the greater of income or net worth, or (b) $2,500. If the investor’s annual income and net worth are both greater than $124,000, then the investor can invest up to 10% of the greater of the two. The max an investor may invest under Reg CF, regardless of income and net worth, is $124,000 per year.

Investor Verification

The exemptions also differ as to issuer responsibility in verifying investor eligibility. Neither Tier 1 nor Rule 504 require verification of investor status. Tier 2 and Rule 506(b) simply ask that an investor “self-certify,” and Reg CF does the same but gives crowdfunding portals the authority to require more. Similarly, Rules 147 allow investors to self-certify as to their state of residency. Issuers conducting a Rule 506(c) offering must be more diligent in the process of verification. As a result, issuers are required to collect documents proving the investor’s claimed financials to confirm that they meet accreditation muster.

Investor Education Requirement

The only exemptions with specific investor education requirements are § 4(a)(2) and Rule 506(b) (investors must meet specific sophistication requirements) and Reg CF (intermediaries must provide investors with specific educational materials).

All offerees in a § 4(a)(2) offering must be sophisticated with access to the type of information that registration would disclose or be able to bear the economic risk of the investment—the investors must be able to “fend for themselves” so as not to need the protections of the Securities Act. Companies selling to non-accredited investors under Rule 506(b), either alone or with a purchaser representative, must ensure that the investor has sufficient knowledge and experience in financial and business matters to be capable of evaluating the merits and risks of the prospective investment. This definition leaves room for interpretation, but it is important that the company has an internal set of standards used to determine whether an investor is sophisticated.

Similarly, Reg CF requires that intermediaries distribute informational materials to investors, both accredited and non-accredited. Intermediaries must provide disclosures and investor educational materials that are written in plain language at the time potential investors open accounts with the funding portal. Specifically, they must provide disclosures explaining the risk and exposure of investment and must receive an affirmative acknowledgment of investor understanding before allowing an individual to participate on the intermediary’s platform.

State Preemption

As mentioned above, every offering is subject to both federal and state securities laws. A significant benefit of a select few exemptions is that they preempt state blue sky laws requiring registration. Tier 1 offerings require companies to register or qualify their offering in any state in which they seek to offer or sell securities, through a process known as “coordinated review.” On the other hand, Tier 2 offerings are exempt from state registration and qualification requirements, but the issuers are still subject to state law enforcement, antifraud authority, filing fees, and other state filing requirements.

Offerings under § 4(a)(2), Rule 504, Rules 147, and Rule 701 do not preempt state securities laws, and companies conducting such offerings must comply with the blue sky laws of each and every state in which they are offering securities. Rule 506 takes a different approach, which is identical to Tier 2 preemption. Under Section 18 of the Securities Act: Rule 506 offerings are exempt from state registration and review. Nonetheless, states maintain the authority to investigate and bring enforcement actions for fraud, impose state notice filing requirements, and collect state fees, which can be relatively expensive. Likewise, offerings pursuant to Reg CF preempt state laws, but the offering may be subject to notice filings and fees in the issuer’s state and any state in which greater than 50% of the purchasers reside. No matter the federal exemption a company intends to use, it should always seek further guidance on compliance with state law requirements.

Advertising and General Solicitation

Another area that distinguishes the exemptions is how companies are permitted to reach investors and advertise their offerings. Both Tiers of Reg A+ and Rule 506(c) allow unlimited solicitation and general advertising. Similarly, the intrastate offering exemptions allow general solicitation and advertising, but only within the state where the offering is conducted—and it can be a challenge to restrict advertising, especially online advertising (including on the issuer’s website) from people outside the borders of a specific state. In contrast, all of the other exemptions limit the ways in which a company can offer its securities.

Rule 504 and Reg CF compromise on somewhat of a middle-ground. As a general rule, companies electing to use Rule 504 may not advertise or generally solicit, unless one of the enumerated exceptions apply, these include: (a) selling in accordance with a state law requiring the public filing and delivery to investors of a substantive disclosure document; (b) selling in accordance with a state law requiring registration and disclosure document delivery and also selling in a state without those requirements, as long as the disclosure documents are delivered to the potential investors in all such states of solicitation; or (c) selling exclusively according to state law exemptions permitting general solicitation and advertising, so long as sales are made only to accredited investors. Therefore, even though Rule 504 generally prohibits advertising and general solicitation, certain circumstances may permit otherwise. Reg CF allows for “limited notices” that must direct a potential investor to the intermediary’s platform through which the offering is being conducted. Such notices can include no more than (a) a statement that the issuer is conducting an offering, the name of the intermediary, and a link to the platform; (b) the terms of the offering; and (c) limited, general information about the issuer.

Advertising and general solicitation is prohibited in § 4(a)(2) and Rule 506(b) offerings. Like Rule 504 offerings not satisfying an exclusion, such offerings must be conducted in a private manner to known individuals with a business or personal connection to the issuer or its affiliates.

Filing Requirements and “Testing the Waters”

Reg A+ and Reg CF offerings require documents to be filed with the SEC prior to any offer of securities. However, one characteristic unique to both Reg A+ and Reg CF is that companies may “test the waters” before putting time and money into pre-filing.

So what is testing the waters? Before filing an offering statement with the SEC, a company may solicit interest in its contemplated securities and determine whether there is a sufficient market prior to incurring the full range of legal, accounting, and other costs associated with preparing and filing an offering statement. Companies testing the waters must include certain language, or legends, in solicitation materials notifying investors that no money for securities is currently being solicited and that any indication of interest is non-binding. Nonetheless, this could be a great way of predicting the success of a potential Reg A+ or Reg CF offering, and avoiding fruitless expense.

While companies using Rules 504 and 506 are not required to pre-file with the SEC before conducting an offering, they must file a notice on Form D within 15 days of the first sale of securities indicating the amount and nature of the offering. There is no filing required with the SEC for § 4(a)(2), Rules 147, and Rule 701 offerings, either prior to or after the start of the raise.

Offering Documents

Each exemption has different requirements for exactly what information must be provided to potential investors; however, every exemption requires that any information delivered to investors is not misleading or fraudulent. While Rule 504 and Rules 147 have no specific disclosure requirements (other than legend requirements regarding the limits on resales), many of the other rules are far more strict in this area.

Rule 506(b) lets issuers decide what information to give to accredited investors but requires companies to provide non-accredited investors with disclosure documents generally equivalent to those used in registered offerings, usually through a Private Placement Memorandum (or “PPM”). Additionally, all information provided to accredited investors must also be given to non-accredited investors. Contrast this with offerings under Rule 506(c): Companies do not have to comply with document disclosure requirements because all investors must be accredited and, theoretically, should have the judgment and bargaining power to request any information needed to make an informed decision about the investment. In all 506 offerings, companies must be available to answer questions from potential investors. Similarly, § 4(a)(2) requires an issuer to disclose the type of information that registration under the Securities Act would require—meaning registration with the SEC should be unnecessary because investors are receiving all material information directly from the issuer.

Reg A+ requires companies to deliver to all investors offering circulars that are first approved by the SEC. Like Reg A+, Reg CF is stricter in terms of offering documents. The Reg CF doors are open to a wider pool of investors, but issuers need to file a Form C with the SEC and must make it available for potential investors on the platform at least 21 days before the offering commences. Along with typical offering and issuer information, the Form C includes the name and background of directors and officers; the identity of 20% beneficial holders of voting securities in the company; the financial condition of the business; the issuer’s ownership, capitalization, and indebtedness; and related party transactions. Issuers and intermediaries must be very precise in confirming the information provided on the Form C to avoid liability.

Finally, under Rule 701, an issuer offering less than $10,000,000 in a 12-month period need only deliver a copy of the compensatory benefit plan to offerees. If the offering is greater than $10,000,000, additional disclosures containing a summary of the plan, information about the risks associated with the investment, and financial statements must also be delivered to investors.

Financial Disclosures

A very important concern for many companies is what level of financial information must be disclosed in connection with their offering. Audits and certification from a certified public accountant (“CPA”) can be timely and costly and are required to qualify for certain exemptions. Rules 504, 506(c), and 147 do not require the delivery of any particular financial disclosures. Alternatively, Tier 1 and Tier 2 issuers must provide balance sheets and other financial statements for the two most recently completed fiscal years, or for such shorter time that the company has been in existence. Tier 2 issuers must have the financial statements audited by an independent auditor. If conducting an offering under Rule 701 that is greater than $10,000,000, the issuer must provide the same financial statements that are required under Reg A+.

Rule 506(b) and Reg CF have similar requirements for financial disclosures that differ depending on various factors. Under Rule 506(b), companies must provide for offerings: (a) up to $2,000,000, audited balance sheets for the two most recent fiscal years, statements of income, and interim quarterly financial statements; (b) between $2,000,000 and $7,500,000, the same financials as required for offerings up to $2,000,000, except the financial statements must be audited; and (c) greater than $7,500,000, the same financial statements required to be filed in a registration statement. If a company other than a limited partnership cannot obtain audited financial statements without unreasonable effort or expense, only the company’s balance sheet must be audited. Limited partnerships unable to obtain required financial statements without unreasonable effort or expense may furnish financial statements prepared under the far more lenient federal income tax laws and examined by an independent accountant.

Reg CF financial disclosures depend on the amount being raised and whether the company is a first-time issuer. If the amount of the offering is: (a) under $124,000, then preparation of financial documents may be conducted internally and certified by the company’s CEO; (b) between $124,000 and $618,000, then the company must submit financials reviewed by an independent CPA; and (c) more than $618,000, then the financials must be audited by an independent CPA. The SEC loosens the requirements for first-time crowdfunding issuers that are offering more than $618,000, permitting reviewed, rather than audited, financial statements.

Ongoing Disclosures & Termination of Ongoing Reporting

Each of the offerings naturally differ in regard to what ongoing information must be provided to the SEC. Tier 1 requires updates of certain issuer information in an exit report filed electronically, no later than 30 calendar days after termination or completion of the offering. Tier 2, on the other hand, requires electronic filing while the offering is ongoing of annual reports, semiannual reports, interim current event updates, as well as the exit report at the termination or completion of the offering.

Similarly, Reg CF requires that an amendment on Form C/A be filed when material changes or updates occur to the offering. Likewise, an issuer must provide an update on Form C-U no later than 5 business days upon reaching 50% and 100% of its target offering amount, unless the intermediary provides progress updates on its platform. Annual reports must also be filed with the SEC and on the issuer’s website that contain similar information to the offering statement.

Compared to the rigid ongoing reporting obligations of Reg A+, Reg D’s ongoing reporting is practically non-existent. No ongoing reporting or disclosures are required for Rules 504 and 506, except that an amended Form D must be filed with the SEC when certain material changes occur to the offering and annually for as long as the offering continues.

Closing Speed

Companies raising capital may also want to consider the urgency of their particular circumstance and liquidity needs.

Selling securities pursuant to Reg A+ depends on prior approval and “notice of qualification” from the SEC after staff review of company offering materials. This process of approval and SEC involvement in Reg A+ offerings are very different than the arms-length involvement and speed of closings for § 4(a)(2), Reg D, Rules 147, and Rule 701 offerings (again, Rules 504 and 506 simply require the filing of a Form D after the first sale has been made and no filing is required under § 4(a)(2), Rules 147, and Rule 701). However, although a federal exemption may allow for a quick close, registration or extensive pre-filings may still be required at the state level, so an issuer should talk to its attorney as soon as possible in the planning stages to prepare a realistic timeline for close.

Transfer Restrictions

Some of the noted exemptions require that the offered securities be restricted. “Restricted securities” are securities issued in private offerings that must be held by purchasers for a certain period of time before they can be resold. Therefore, Reg A+ securities can be resold unrestricted, whereas securities purchased in § 4(a)(2), Reg D, Reg CF, Rules 147, and Rule 701 offerings are restricted. Under § 4(a)(2), Reg D, and Rule 701, generally the securities may not be resold absent registration or qualifying for an exemption. Reg CF securities must be held for one (1) year after the offering, unless they’re transferred to the issuer, an accredited investor, family members or as part of a registered offering. Securities purchased in Rules 147 offerings can only be resold to residents of the state of the offering for a period of six (6) months after the sale by the issuer. These limitations on resale must be disclosed to offerees and may affect a potential investor’s willingness to purchase the securities, thus must be taken into account by the issuer prior to the start of the offering.

Intermediary

Unlike the other listed exemptions, companies using Reg CF must use an intermediary—they cannot crowdfund on their own. Intermediaries are licensed broker-dealers or online funding portals.

Other exemptions permit the use of intermediaries, but such intermediaries generally must be registered. Both federal and state law prohibit a person from engaging in the business of facilitating securities transactions without a license, meaning a person engaged in such activity must be licensed as a broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”), or be a licensed representative of a FINRA member. There are limited exceptions from broker-dealer registration for “finders” and intermediaries that do not receive any form compensation, directly or indirectly, in connection with the offer or sale of the securities. However, issuers will be hard-pressed to find an intermediary that will work for free.

Again, please note that the information above is informative only in nature, is subject to change, and shall not be construed as offering legal advice in any way. Please consult with an attorney for specific application of any exemption.