Comparing the Conversion Mechanics of Safes and Convertible Notes

May 10, 2024 | By Bobby Gojuangco

Due to widespread acceptance of the post-money Safe as the preferred investment agreement for pre-seed financings, all references to “Safes” in this post refer specifically to Y Combinator’s post-money Safe. [1] On the other hand, convertible notes are far less standardized, and the terms can be highly customized. However, the majority of convertible notes we see in practice today continue to use pre-money valuation caps. As such, all references to “convertible notes” in this post refer to notes with a pre-money valuation cap.

Equity Financing vs. Safes and Convertible Notes

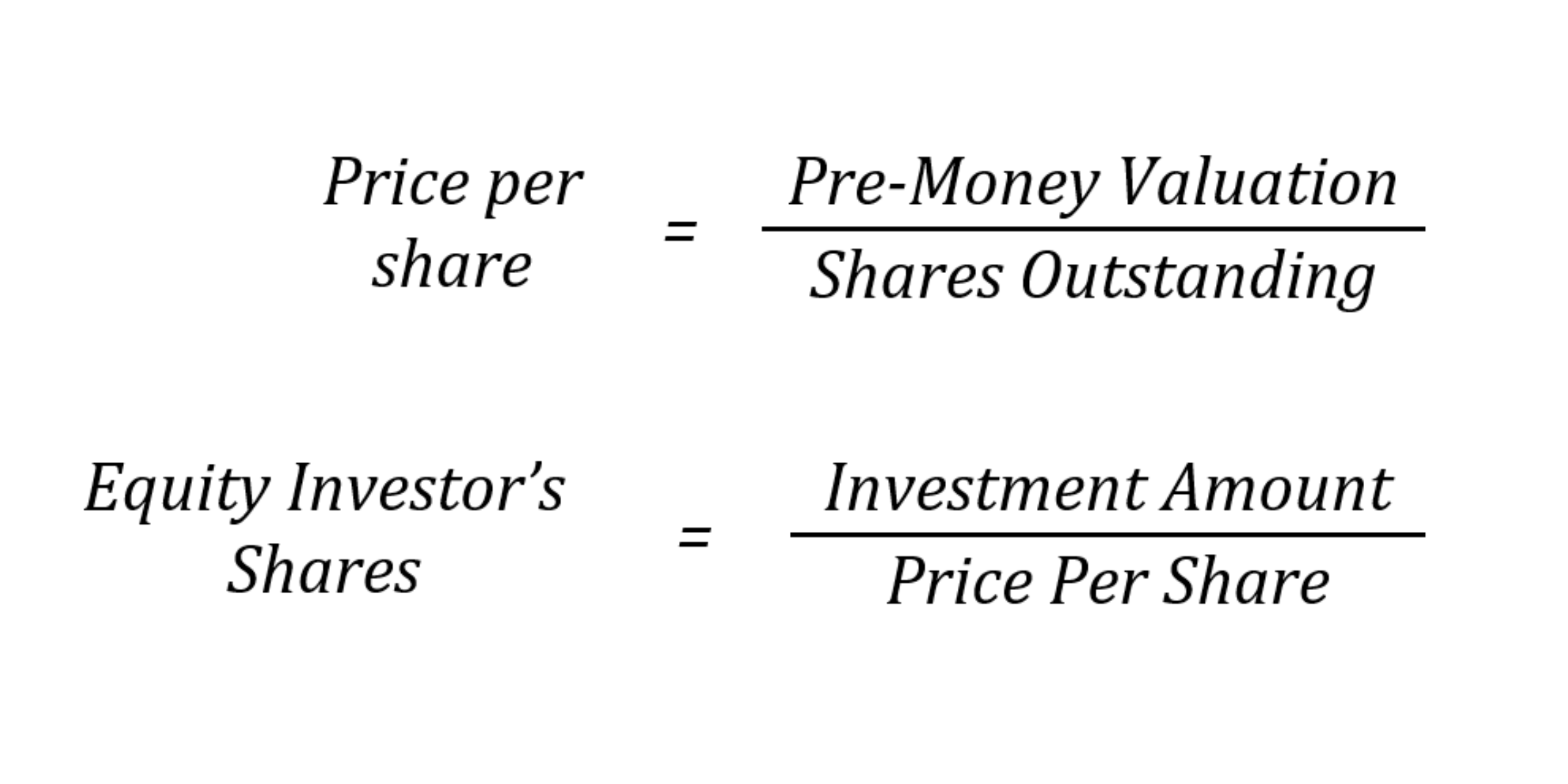

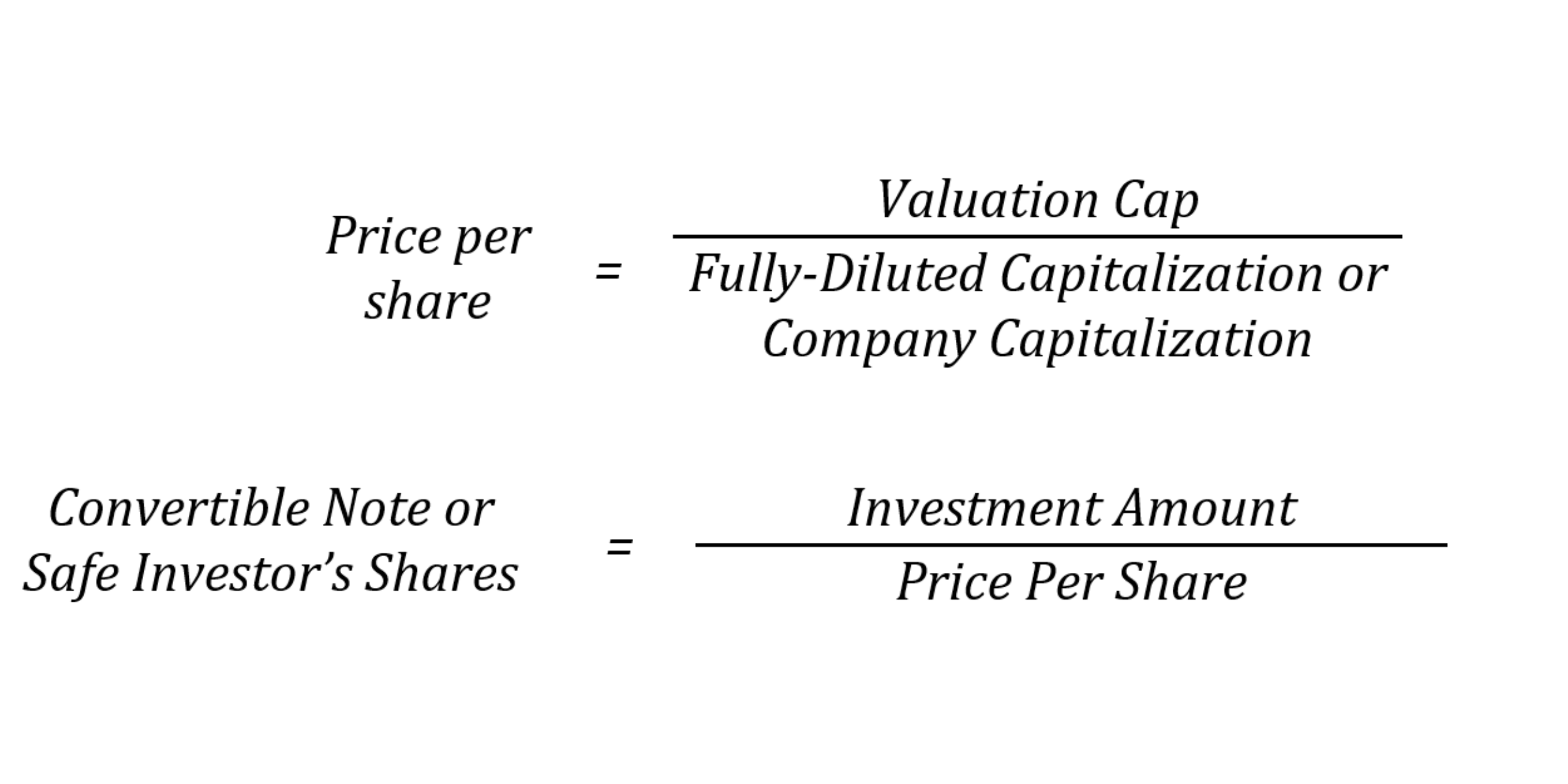

Determining the price per share for an equity round is relatively easy—you simply divide the pre-money valuation by the company’s total shares outstanding. The equity investors will then take their investment amount and divide that by said price per share. The resulting number of shares will be owned by the equity investors and the company’s capitalization will increase by the same number. The principal difference between Safes and convertible notes lies in their treatment of “shares outstanding” when determining price per share. In most convertible notes, this is referred to as Fully-Diluted Capitalization. In Safes, this is referred to as Company Capitalization. This total directly affects the conversion share price because it serves as the denominator in calculating “price per share.” Therefore, a smaller amount of “shares outstanding” will produce a greater price per share, which in turn means the instrument will convert into less equity, and vice versa.

The principal difference between Safes and convertible notes lies in their treatment of “shares outstanding” when determining price per share. In most convertible notes, this is referred to as Fully-Diluted Capitalization. In Safes, this is referred to as Company Capitalization. This total directly affects the conversion share price because it serves as the denominator in calculating “price per share.” Therefore, a smaller amount of “shares outstanding” will produce a greater price per share, which in turn means the instrument will convert into less equity, and vice versa.

Fully-Diluted Capitalization (Convertible Notes)

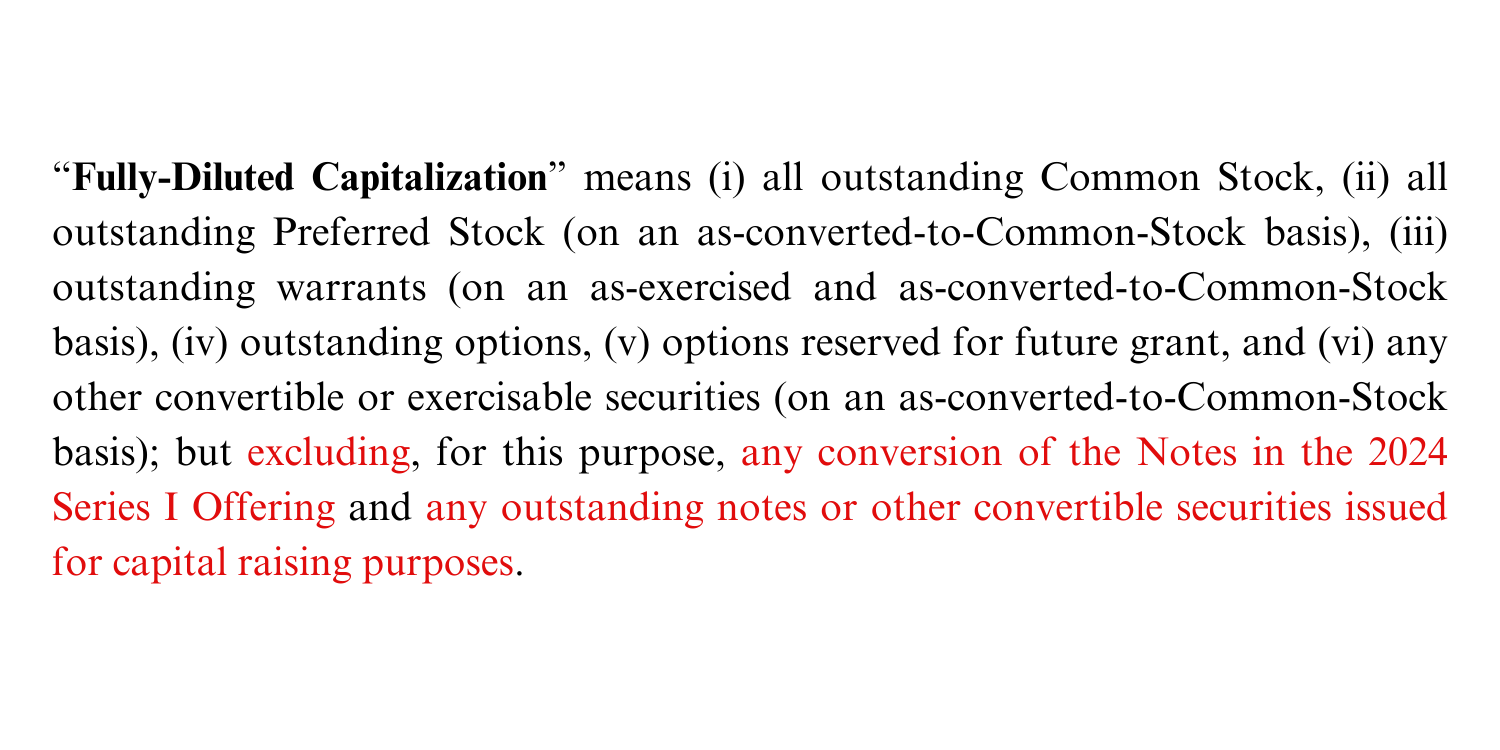

Generally, the definition of Fully-Diluted Capitalization in most convertible notes contain company friendly language, whereas Safes define Company Capitalization in a more investor friendly manner (i.e., all other terms being equal, Fully-Diluted Capitalization converts into less shares and Company Capitalization converts into more shares). Let’s look at an excerpt of a typical Fully-Diluted Capitalization definition to understand why: Focusing on the emphasized text in red, the conversion of convertible notes based on this language means this convertible note itself, other convertible notes, other Safes, and any other convertible securities will not be included in the Fully-Diluted Capitalization total. The price per share will have a smaller denominator, and this noteholder’s investment will thus convert into less shares.

Focusing on the emphasized text in red, the conversion of convertible notes based on this language means this convertible note itself, other convertible notes, other Safes, and any other convertible securities will not be included in the Fully-Diluted Capitalization total. The price per share will have a smaller denominator, and this noteholder’s investment will thus convert into less shares.

Furthermore, if and when the Company undergoes another convertible instrument round, you’ll see that the definition will continuously reduce all of the convertible noteholders’ future conversion amounts. As more notes are added, Fully-Diluted Capitalization remains fixed, and the noteholders will pay a comparatively more expensive amount per share than a Safeholder would. However, because more notes are added, the equity investors’ price per share will continuously get cheaper—remember, they get to include all shares outstanding in their denominator for price per share: (i) common stock, (ii) previously issued preferred stock, (iii) stock issued from the conversion of convertible notes, (iv) stock issued from the conversion of Safes, (v) stock issued upon the exercise of warrants, (vi) the existing option pool, and (vii) expanded option pool. Thus, if more notes are added and the equity investors’ price per share continuously decreases, their investment will buy more shares.

Company Capitalization (Safes)

Now let’s contrast this with Post-Money Safe language.

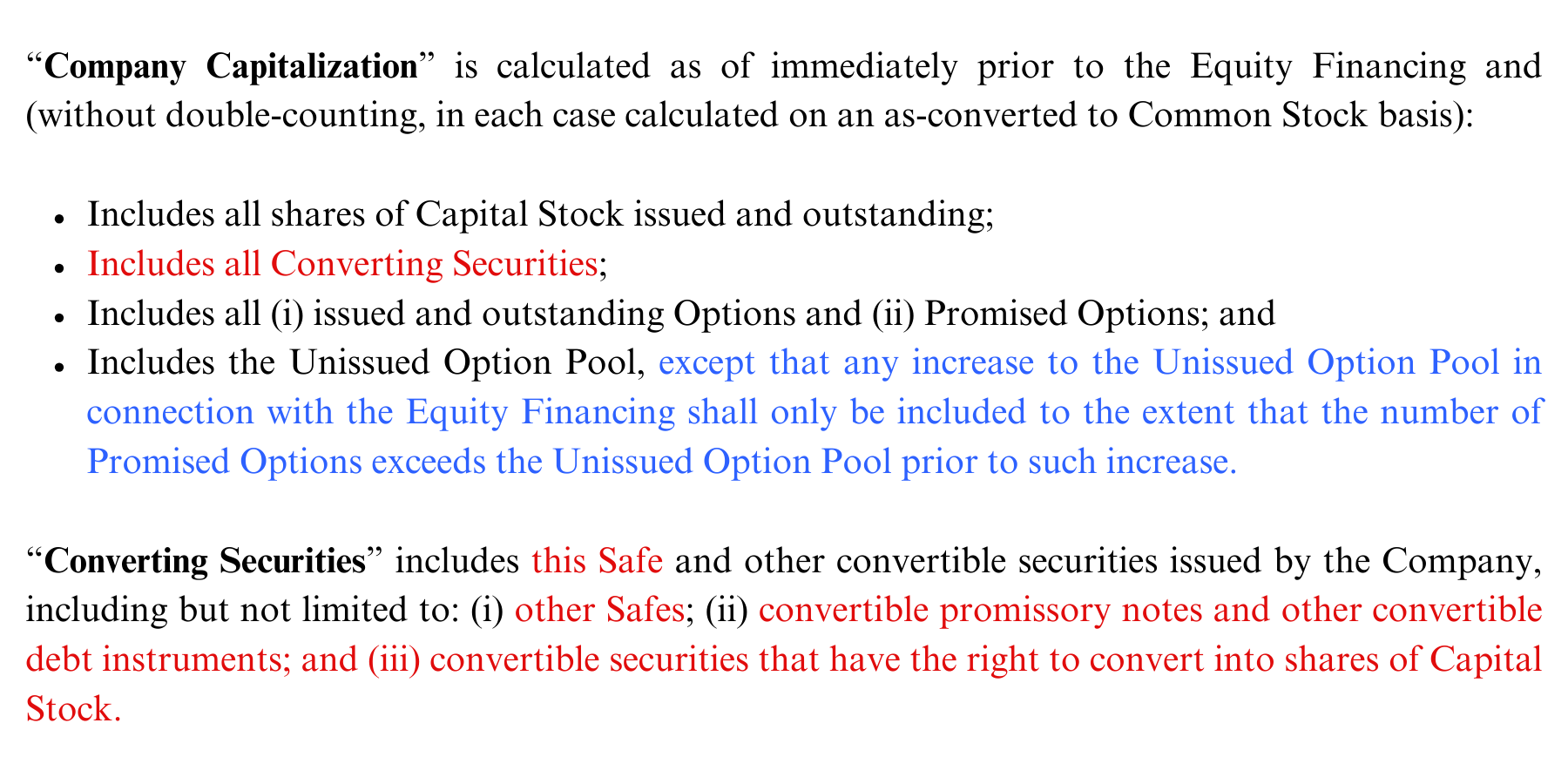

Looking at the red text, we can see that a Safe’s price per share will have a much larger denominator compared to that of a convertible note. Rather than excluding the instrument itself and other convertible securities, Company Capitalization loops in everything (well, almost everything—more on that below). The Safeholder’s investment will therefore convert at a lower price per share and the investor will in turn end up with a larger portion on the cap table.

Pre-Money vs. Post-Money

What happens when more convertible instruments are purchased? Unlike convertible notes, Safes get the benefit of getting proportionately cheaper when other Safes or convertible notes are added: the definition of Company Capitalization provides that all converting securities are included. This means the denominator of price per share will grow, and thus the purchase price decreases.

This very concept summarizes what is meant by convertible notes being “pre-money” instruments and Safes being “post-money.” Safe conversion prices are determined on a shares outstanding total after the convertible instruments are taken into account (i.e., post-all convertible instruments, i.e., post-money). Price per share proportionately decreases when new money is taken in, which means the Safeholder’s investment buys a fixed proportion of the Company. For example, a $100K Safe on a $1M post-money valuation = ~10% ownership (more on that here). If the Company oversubscribes and takes in a second $100K Safe on the same terms, the Founders can expect ~20% dilution upon conversion and both Safeholders remain assured they will each convert into ~10% regardless of how many additional rounds of convertibles are completed. Due to this “anti-dilutive” effect, Founders should think very carefully before stacking multiple rounds of post-money Safes. Two Safe rounds at 20% dilution is not the same as two priced rounds at 20% dilution.

Convertible notes, on the other hand, dilute each other. Convertible note prices are determined on a shares outstanding total before the investments are taken into account (i.e., pre-all investments, i.e., pre-money). If the Company raises a $100K convertible note on a $900K pre-money valuation ($1M post-money valuation), the noteholder—like the first Safeholder—purchased ~10%. However, if the Company oversubscribes and raises a second $100K convertible note on the same terms, the resulting post-money valuation would be $1.1M ($900K pre-money valuation + $200K new money) and the noteholders would only own ~9.9% each. This result only compounds as more Notes are raised: five investors purchasing $100K convertible notes would result in a $1.4M post-money valuation ($900K pre-money valuation + $500K new money) and an approximate ownership of 7.1% each. Put differently, raising more convertible notes means the noteholders will pay a fixed price per share while the equity investors get to purchase at a cheaper and cheaper price. As a result, the equity investors’ new money buys them more of the Company, while the noteholders’ piece of the pie will continue to shrink.

Now, Post-Money Safes make one small concession so that they are not completely detrimental when converting compared to convertible notes: the exclusion of the expanded option pool. When companies undergo an equity round, they often consider (and need to) increase the employee option pool to prepare for future employee/advisor/contractor growth—aka an option pool “refresh.” At the same time, the equity investors want to ensure the pool is increased in connection with the round so they aren’t diluted by an option pool refresh after the round (though note that preferred investors usually enjoy a preferred stock protective provision if the company later desires to increase the number of authorized shares to increase the option pool). Both types of convertible instruments include the existing option pool—the unissued options that remain available as part of a previously established employee option plan. However, the difference lies in the newly created options as part of the equity financing round. Convertible notes treat the option pool refresh in a noteholder-friendly way: Fully Diluted Capitalization includes the option pool refresh. Looking at the blue text above, Safes take the tradeoff by expressly excluding such options from Company Capitalization.

In conclusion, Founders must be aware of these fundamental differences when offering or receiving an offer to undergo financing via convertible instruments, as these directly affect the inevitable dilution you will experience. If you can understand and plan for such dilution, and actually raise the amount you initially set out, you can focus on the other considerations between convertible notes and Safes when deciding which instrument to use.

[1] As of 2023, 77% of Safes were on the post-money Safe form. See Peter Walker, Carta (April 2024). As of Q1 2024, approximately 80% of pre-seed rounds used Safes. See Peter Walker, Carta (Jan. 2024).