When is a Stock Sale not a Stock Sale? When it’s a Section 338(h)(10) Sale

September 29, 2022 | By Candace Groth

It is time to revisit the differences between an acquisition structured as an Asset Sale versus one structured as a Stock Sale, before we talk a little bit about the quirky and misunderstood Section 338(h)(10) election.

Asset Sale Versus Stock Sale

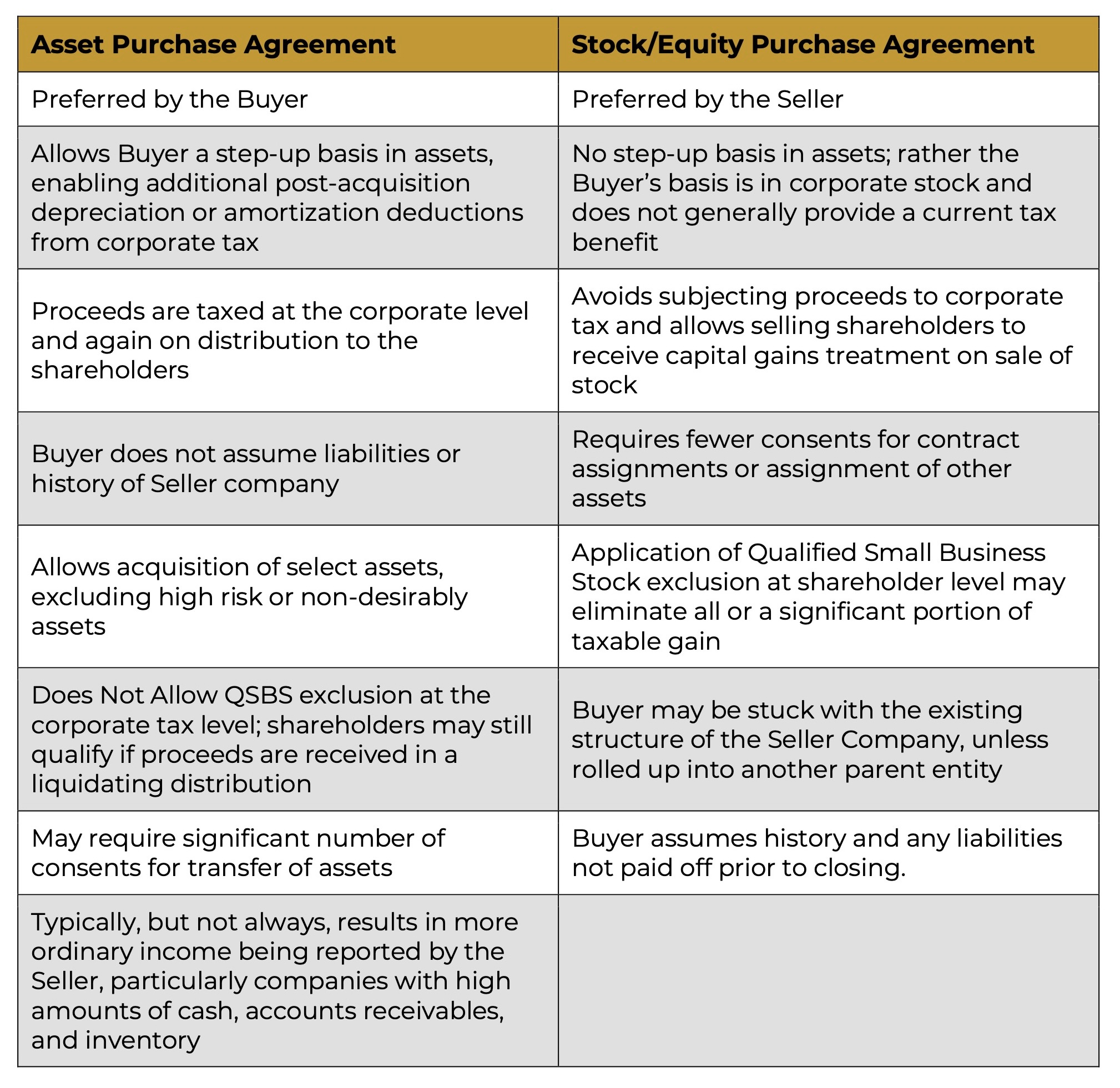

The Buyer and Seller in an acquisition are often, but not always, at odds regarding the structure they prefer for an acquisition of the Company. You will see some of the reasons why outlined in the table below

As the above table reflects, generally the Buyer in a transaction will prefer to structure the transaction as an asset sale, assuming that they are not concerned about assigning contracts and other assets of the business, or lengthier permitting processes. The Seller in a transaction will generally prefer a Stock Sale, to allow for capital gains treatment of the transaction proceeds, maximize the QSBS exemption, and avoid the corporate tax.

The Section 338(h)(10) Election

But what if the Buyer needs the transaction to qualify as a stock sale, but wants the advantages of asset sale tax treatment? Enter the Section 338(h)(10) election.

The Section 338(h)(10) election, and its sister, the Section 336(e) election, allow the Buyer and Seller (assuming the target seller meets the requirements) in a stock sale transaction to jointly make an election in order to treat the sale like a stock sale for structural purposes, but like an asset sale for tax purposes.

Target Company Requirements: Must be a U.S. corporate subsidiary of a parent company or an S-Corporation.

Buyer Requirements: Buyer must be a corporation making an acquisition of at least 80 percent of the Target Company’s stock.

Result: Buyer and Seller will agree on an allocation schedule allocating a portion of the purchase price to one of seven categories of assets. You can read more about the allocation schedule in our blog post here.

Advantages:

- Buyer receives asset sale treatment, which typically results in quicker depreciation/amortization of assets versus a stock sale

- Both parties get to use the stock sale structure for non-tax purposes, which may make transition of customer agreements, vendor agreements, and overall business operations easier

Disadvantages:

- Not available to LLC’s taxed as partnerships or disregarded entities

- Seller transaction proceeds will be subject to two layers of tax: the corporate tax due on the deemed asset sale, and shareholder capital gains tax due on the deemed liquidating distribution

- The Qualified Small Business Stock exemption may be limited or not apply

The Section 338(h)(10) election and buying or selling a business can be complex. That is why it is critical to consult with an attorney who is comfortable doing these types of transactions to be sure you get them right. Hopefully, this post will help you understand the Section 338(h)(1) election, and provide a starting point for consideration of this topic in the context of the larger sale transaction.