What is an F-Reorganization?

May 3, 2022 | By Candace Groth

If you have tried to sell or buy a business that is an S-corporation for tax purposes recently, you may have run into the newly popular structure called the “F-Reorganization.” But what on earth is an F-reorganization? And why is it so popular? This blog post explains the structure.

What is it?

An F-reorganization is a type of typically tax-free reorganizational structure that often involves a target company taxed as an S-corporation. The F-reorganization is so named because it involves a change in “form” of the target, while not changing the substance of the target for tax purposes.

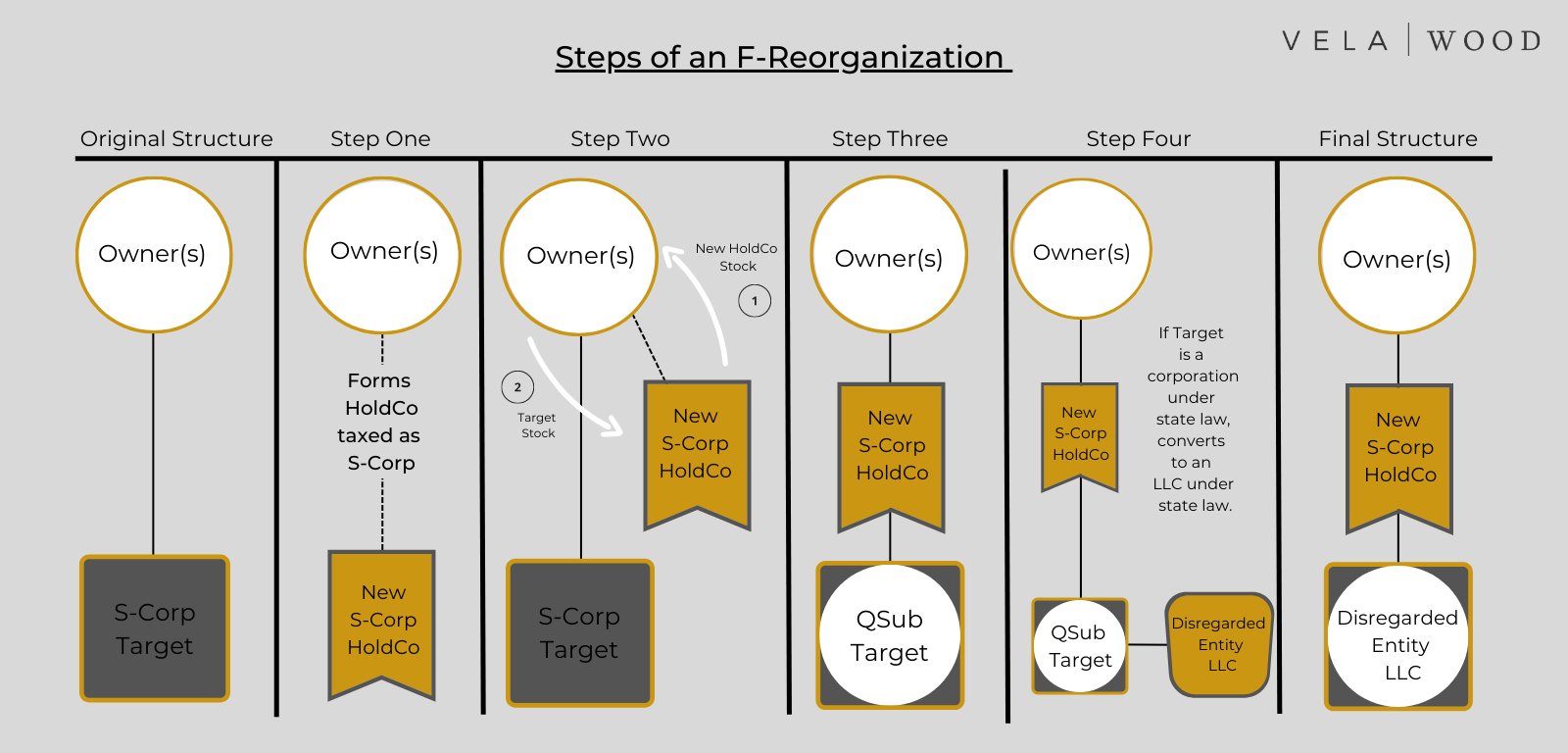

- Step 1: The owners of Target company form Newco, an LLC or corporation taxed as an S-corporation.

- Step 2: The Owners of Target contribute 100% of their ownership in Target (either shares or Membership Interests/Units) to Newco in exchange for their new ownership in Newco. The percentage ownership in Newco is typically identical to the ownership the owners had in Target.

- Step 3: Target becomes an S-corporation subsidiary of Newco, another S-corporation. Target and Newco file a Qsub election so that Target may be treated as a Qsub (an S-corporation subsidiary of an S-corporation).

- Step 4: If Target is structured as a state law corporation, Target converts under state law from a corporation to an LLC.

- Step 5: At least one day after the conversion, Target files an election form for Target to be treated as a disregarded entity (a 100% owned subsidiary of Newco).

By the end of the process, the Owners own Newco, which is taxed as an S-corporation. Target is a 100% owned subsidiary of Newco. The Buyer can acquire the membership interests/units of Target from Newco at closing, with the sale price flowing through to the Owners in their respective percentages. The F-reorganization is typically used during an acquisition transaction involving a Buyer and a Seller. However, it can also be used for restructuring by the Target and its owners alone also.

Why?

An F-Reorganization is typically used in order to restructure the Target entity and its assets prior to sale to a Buyer.

Seller (Target/Target Owner) Benefits Include:

- Avoiding obtaining legal consents or incurring transfer taxes to create a 100% owned subsidiary that owns some of the assets of Target

- The F-reorganization structure allows more flexibility than using options like an IRC Section 338(h)(10) election or an IRC Section 336(e) election. This includes the ability for the Buyer to structure the purchase price with a greater mix of cash and Buyer stock (rollover compensation).

Seller Disadvantages:

- Increased legal and other costs to effectuate the pre-closing F-reorganization

- Increased complexity of the underlying transaction

- Risk of the F-reorganization and its validity is typically born by the Seller (even if the structure is requested by the Buyer).

Buyer Benefits Include:

- Allows Buyer to get a step-up in the basis of the Target’s assets at sale equal to the amount paid for the Seller’s LLC interest, while still using an Equity Purchase Structure (reducing the number of consents needed)

- Retains Target’s operating history, creditworthiness, and other attributes

- Reduces Buyer’s risk (potentially) if there are concerns regarding Target’s initial S-corporation election, including its validity or timing

- Removes the need to terminate the Target’s S-corporation election at closing

Buyer Disadvantages:

- The tax filings involved in the transaction will not be received until months after closing, creating unknown risks.

- Transaction liability risks of an equity sale, even when structured this way, are still usually higher than an asset sale transaction.

We know this is a lot to digest and selling (or buying) a business can be complicated. That is why it is critical to consult with an attorney who is comfortable doing these types of transactions to be sure you get them right. Hopefully, this post will help you understand F-reorganizations, and provide a starting point for consideration of these items in the context of the larger sale transaction.