Understanding Authorized, Issued and Reserved Shares

March 26, 2023 | By Alyson Rubio

Understanding the different classifications of stock is essential for a corporation to effectively and efficiently utilize one of its most valuable resources – its capital stock. In this blog we’ll explore the difference between a corporation’s authorized, issued and reserved shares and some corporate governance considerations to keep in mind as shares, options, and warrants are being issued to founders, service providers, and investors.

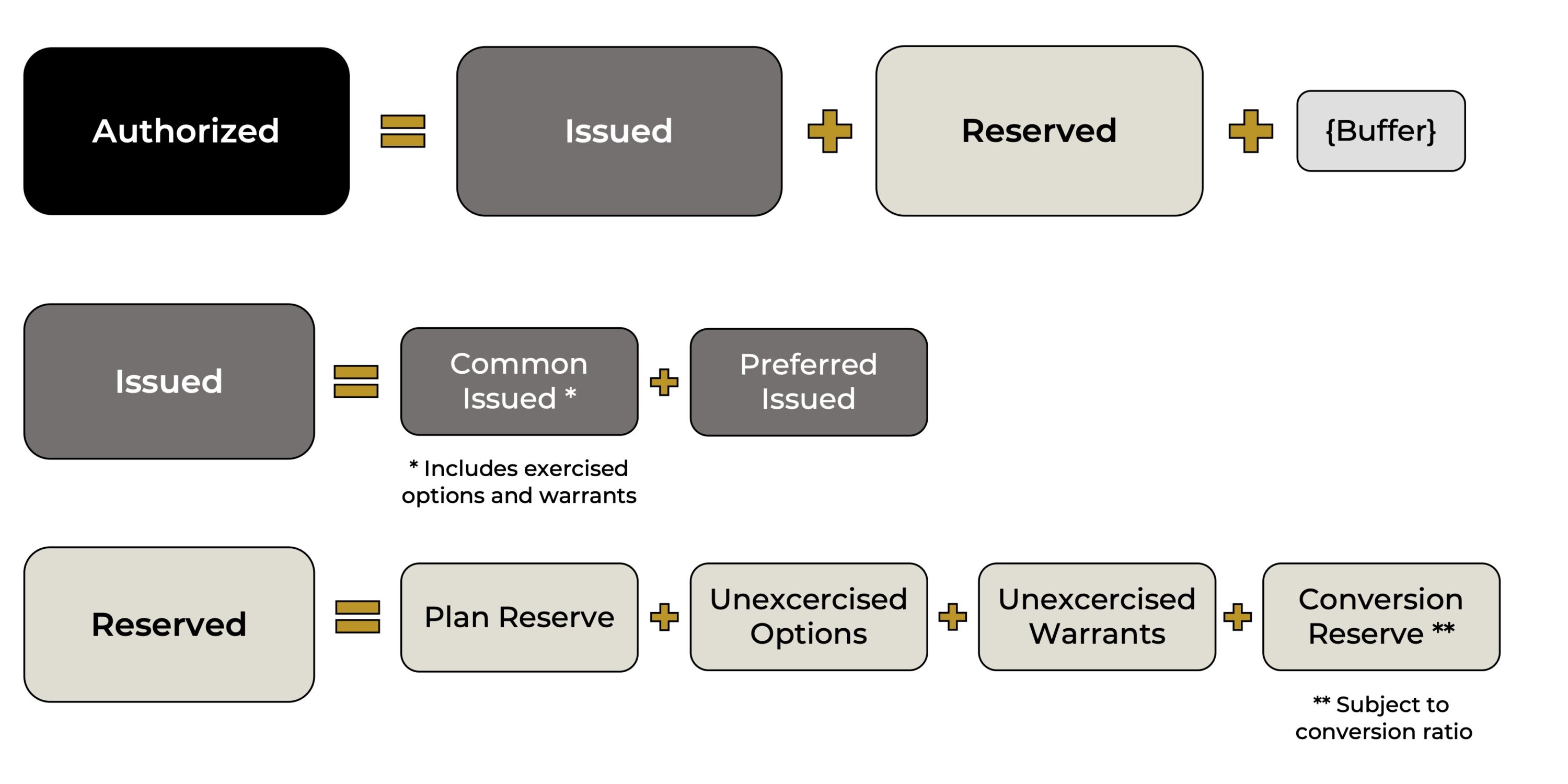

Authorized Shares

“Authorized Shares” are the number of shares authorized by a corporation, which is the maximum number of shares that the corporation can legally issue. This number is set forth in the corporation’s state formation documents. The number of Authorized Shares must account for all of the corporation’s Issued Shares and Reserved Shares. If a corporation wishes to issue additional shares when no Authorized Shares are available for such issuance, the number of Authorized Shares set forth in the formation documents must be amended prior to such issuance, which generally requires an amendment to the corporation’s charter and an accompanying board and stockholder consent.

Issued Shares

“Issued Shares” are the number of shares the corporation has actually sold or granted to shareholders. This number includes all issued Common Stock and issued Preferred Stock, as well as exercised stock options and warrants.

Reserved Shares

“Reserved Shares” are the corporation’s shares that are reserved for some future purpose and will not otherwise be issued to shareholders. Reserved Shares consist of authorized but unissued shares and may only be issued in connection with the purpose for which they were reserved. Some shares are required to be reserved. For example, if a corporation issues Preferred Stock, the corporation must reserve enough shares for the Preferred Stock to convert into shares of Common Stock. Similarly, if a corporation issues warrants, the corporation must reserve enough shares for the warrants to convert into the applicable shares of stock. A corporation must also reserve that number of shares of Common Stock underlying the corporation’s stock option plan.

As stated above, a corporation’s Authorized Shares should, at a minimum, be the sum of its Issued Shares and Reserved Shares. Sometimes a corporation may also include a small buffer of Authorized Shares over the Issued Shares and Reserved Shares to accommodate nominal future grants. A corporation should be careful to avoid issuing shares of stock in excess of the number of its Authorized Shares. Such issuance is known as a “Putative Issuance” and depending on the laws of the corporation’s state of formation, may require specific (and costly) remedial measures to be taken in order to remedy a potentially void or voidable issuance.