Stockholders’ Rights of Venture Investors After Moelis

May 31, 2024 | By Brian Kim

“Bedrock” Principle of Board Management in Tension with Investor Demands for Control

A “bedrock” principle of Delaware corporate law, rooted in Section 141(a) of the Delaware General Corporation Law (“DGCL”), is that “the business and affairs of a corporation are managed by and under the direction of its board,” and not its stockholders.[1]

When a corporation starts accepting outside equity investments, however, the DGCL-guaranteed power of the board to manage the corporation can come under pressure. Investors might demand certain consent or veto rights over key actions involving the corporation as conditions to their investments. The market practice has been that such demands, if accepted by the target corporation, are memorialized in two different ways:

- Provisions for consent or veto rights in favor of a particular stockholder or a group of stockholders are inserted into the corporation’s certificate of incorporation, the constitutional document for any Delaware corporation.

- The corporation enters into an agreement with a stockholder, a group of stockholders and/or all of its stockholders, which contains approval or veto rights in favor of a particular stockholder or group of stockholders. (Note: Under applicable Delaware law, the bylaws of a corporation also constitute an agreement among the corporation and its stockholders.)

Accommodation of Investor Control Demands in the NVCA Model Documents

The NVCA model documents, which are widely used by venture investors and startups alike, employ both of the foregoing methods for granting investors the approval, veto, or other rights that they may bargain for. On one hand, the NVCA Model Certificate of Incorporation contains protective provisions in favor of preferred stockholders. They require the holders of preferred stock, or some subset thereof, to approve, among other things, certain transactions by the corporation that would otherwise have been approved by board action alone, such as declaring and distributing dividends, incurring debt, or issuing cryptocurrency tokens.[2] On the other hand, the NVCA Model Investors’ Rights Agreement (which is a separate agreement between the target corporation and certain shareholders that is commonly employed in venture financings) contains a number of covenants by the target corporation that are intended to benefit the holders of the corporation’s preferred stock. These covenants include: refraining from taking actions that would harm qualification of the corporation’s preferred stock as “qualified small business stock,” sharing with investors confidential information regarding a potential sale of the corporation, and developing and instituting policies on anti-harassment, DEI, cash management, and cybersecurity. [3][4]

The Moelis Decision: The Limits of Instituting Investor Controls by Agreement

Under Section 141(a) of the DGCL, there are only two ways in which the board’s power to manage the corporation may be curtailed:

- The other provisions of the DGCL may impinge upon the board’s power. (For example, entering into certain fundamental transactions involving the corporation, such as a merger, require the approval of the corporation’s stockholders.)

- The board’s power to manage a corporation may be modified by provisions inserted in the corporation’s certificate of incorporation.

In other words, notwithstanding past market practices – including, in part, the practices in venture capital investments as reflected by the NVCA model documents – the DGCL does not contemplate a curtailment of a board’s right to manage the corporation through an agreement signed by the corporation with its stockholder(s), like an Investors’ Rights Agreement.

The Delaware Chancery Court decided, in the case of West Palm Beach Firefighters’ Pension Fund v. Moelis & Company, that the market practice must yield to the DGCL. It held that a number of provisions in a stockholders’ agreement between a corporation and its founder were unenforceable, as unlawful constraints on the corporation’s board and its management power, in violation of Section 141(a) of the DGCL.[5]

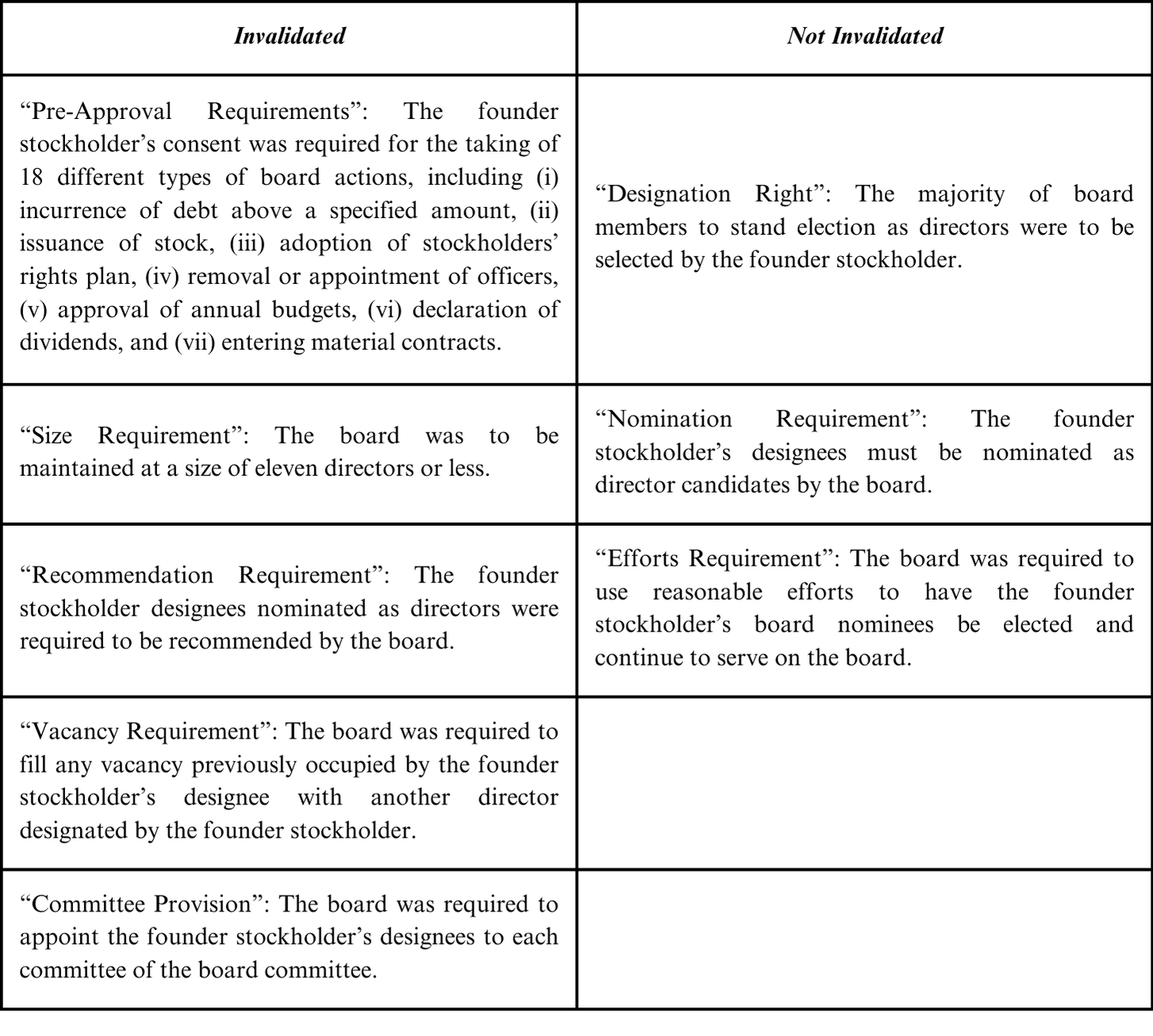

The provisions that were challenged in Moelis were as follows: [6]

In other words, any provision that prohibited the board from exercising its discretion to take or not take any action, or any provision that committed the board to the election of any particular director to the board, was invalidated as a violation of DGCL Section 141(a). In contrast, the founder stockholder’s right to merely designate and nominate certain director candidates, and to have the board facilitate their standing for election as directors, was found by the court to be permissible under DGCL Section 141(a).

Takeaways and Workarounds (esp. NVCA)

Vice Chancellor Laster, who authored the decision, had a simple solution for stockholders wishing to retain control over the corporation in which they own stock: insert the approval and other control rights provisions into the corporation’s certificate of incorporation.[7] In practice, however, there may be a number of reasons why both the target corporation and the investor alike may not want to insert such provisions in the certificate of incorporation:

- The certificate of incorporation is a publicly filed document, and either the corporation or the investor (or both) may not want to reveal the extent to which control over the corporation’s management has been ceded to the investor.

- The certificate of incorporation is a harder document to amend and/or restate, since the approvals of both the board and the stockholders as well as filings with the Delaware Department of State are required to amend the certificate of incorporation, as opposed to an agreement which may be amended by a written instrument executed by the parties that executed the original agreement (or in the case of certain stockholders’ agreements, including the NVCA model documents, by the corporation and a requisite number of stockholders).

- Market practice has sometimes involved the grant of additional governance rights to certain investors via side letters, especially if the equity financing round involves subsequent closings. This provided an easier route of getting the deal done compared to an additional amendment and/or restatement of the target corporation’s certificate of incorporation (see above bullet regarding the comparative difficulty of amending the certificate of incorporation).

In the alternative, any provision in a stockholders’ agreement or similar contract that would bind the corporation to a particular action (or lack of action) in favor of a stockholder could be made subject to the board’s exercise of its discretion as required by the fiduciary duties that the board owes to the corporation. This is also the approach reflected in the latest update made by the NVCA to its Model Investors’ Rights Agreement, where certain covenants binding the target corporation to take or refrain from certain actions (such as refraining from taking actions that would harm qualification of the corporation’s preferred stock as “qualified small business stock,” sharing with investors confidential information regarding a potential sale of the corporation, and developing and instituting policies on anti-harassment, DEI, cash management and cybersecurity), have been made subject to a newly added section, which reads as follows:

“Fiduciary Duties. The Company’s obligations set forth in Sections [ . . . ] that are qualified by this Section 5.20 shall not be applicable to the extent (and only to the extent) that the Board of Directors determine in good faith that compliance would be inconsistent with the exercise of the fiduciary duties of the Board of Directors.”[8]

Finally, a veto-type provision in favor of an investor could be converted into a “requisite director” provision in a stockholders’ agreement, which is then incorporated into the certificate of incorporation, similar to the approach taken in the NVCA Model Investors’ Rights Agreement and the NVCA Model Certificate of Incorporation. However, this strategy would not be usable for provisions that would be intended to compel the corporation to take certain positive actions in favor of the investors.

Future Developments

In response to the Moelis decision, the Council of the Corporation Law Section of the Delaware State Bar Association (DSBA) has approved proposed amendments to the DGCL that would effectively overrule the Moelis decision.

If submitted to Delaware’s General Assembly and enacted into law, the proposed amendments to the DGCL, to be codified as Section 122(18) of the DGCL, would provide that a Delaware corporation has the power to enter into contracts with stockholders for the specific purpose of providing that, among other things, (a) the corporation itself is restricted or prohibited from taking actions specified in the contract, (b) the taking of specified actions by the corporation is conditioned upon the approval or consent of one or more persons or bodies (including the board of directors, or any current or future directors, stockholders, or beneficial owners of stock), or (c) the corporation or one or more persons or bodies (including the board of directors or any current or future directors, stockholders, or beneficial owners of stock) will take, or refrain from taking, actions specified in the contract.

If the proposed amendments to the DGCL are enacted, the pre-Moelis market practice of granting investors certain approval or control rights via agreement will likely be preserved. The proposed amendments, if enacted, are expected to be effective starting on August 1, 2024.

Until the proposed amendments to the DGCL are enacted, however, previous market practices relating to granting and receiving investor approval and control rights will need to be reconsidered in accordance with Moelis. Additionally, the drafting of, and the choice of document implementing, all investor approval and control rights will need to be carefully examined and negotiated.

[1] West Palm Beach Firefighters’ Pension Fund v. Moelis & Company, 311 A.3d 809, 816 (Del. Ch. 2024) (citing Pogostin v. Rice, 480 A.2d 619 (Del. 1984)).

[2] See Article FOURTH, Part B, § 3.3, NVCA Model Certificate of Incorporation (Updated April 2024), accessed at https://nvca.org/recommends/certificate-of-incorporation-updated-april-2024/.

[3] See § 5, NVCA Model Investors’ Rights Agreement (Updated April 2024), accessed at https://nvca.org/recommends/nvca-ira-updated-april-2024/.

[4] Note that the NVCA model documents actually contain a third method by which investors are granted the right, albeit indirectly, to approve or veto certain actions of the corporation – the “requisite director” approval provisions, which grant preferred stockholders approval or veto rights by requiring certain actions be approved by a majority of the board that must include a particular director appointed by the preferred stockholders. While the substance of such requisite director approval provisions is written in the NVCA Model Investors’ Rights Agreement, the provisions are actually incorporated into the NVCA Model Certificate of Incorporation by reference, effectively enshrining such requisite director provisions in the Certificate of Incorporation.

[5] See Moelis, 311 A.3d at 881.

[6] See Moelis, 311 A.3d at 824 – 828, 881.

[7] See Moelis, 311 A.3d at 822 (“[The founding stockholder] could have accomplished the vast majority of what he wanted through the Company’s certificate of incorporation.”)

[8] § 5.20, NVCA Model Investors’ Rights Agreement (Updated April 2024), accessed at https://nvca.org/recommends/nvca-ira-updated-april-2024/.