Dilution Done Well

May 1, 2018 | By Kevin Vela

The word dilution may sound scary to the uninitiated, but it shouldn’t. In fact, dilution is a good thing when done appropriately. The adage is that you’re better off owning a little piece of something worth a lot then owning a lot of something worth a little. As long as the value of the business is increasing proportionately by more than the dilution, then you’re just fine.

Let me highlight this. Assume that you own 100% of your business. During your friends and family round you plan to raise $100k at a $900k pre-money valuation. This means that your investors will dilute you by 10%; you will now own 90% and your investors will own 10%. If your business sold for $1M (let’s assume this is net proceeds and with no liquidation preference to keep it simple), you would receive $900k because 90% of $1M is $900k.

Now, let’s say you subsequently raise a $1M seed round at a $3M pre-money valuation. Your post-money valuation will now be $4M and you will suffer 25% dilution (because new investors $1M/$4M = 25%). 25% sounds like a lot and I see a lot of clients get upset by the thought of this, but in reality this is normal and within a reasonable range of dilution.

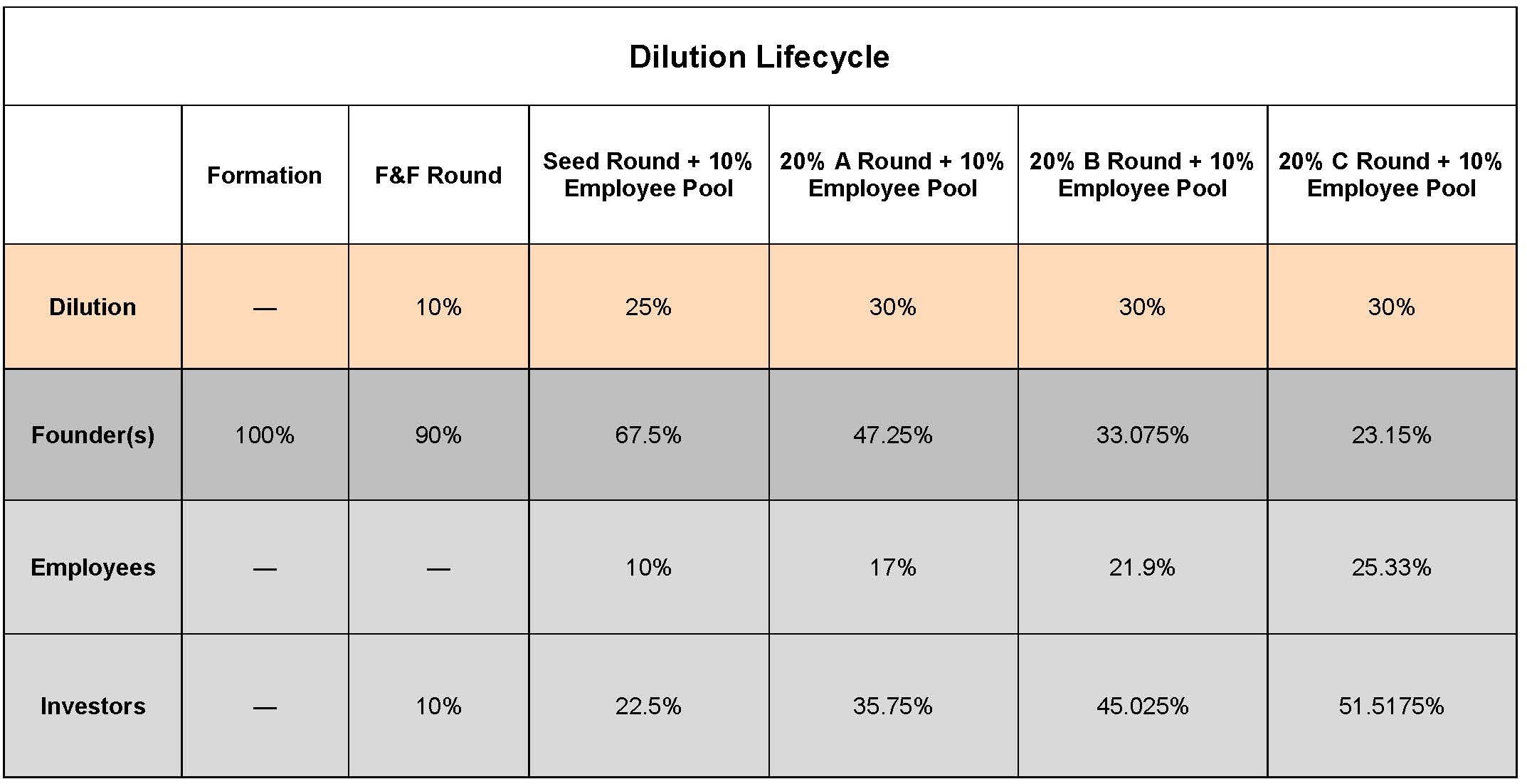

Your 90% ownership is now 67.5% (because 90% * (1-.25) = 67.5%). The friends and family investor(s) would similarly be diluted to 7.5%.

Next let’s assume that you sold the business for $4M. Your return would be $2.7M ($4M x 67.5%). Thus, in the scenario above, after 25% dilution but a 4X increase in post-money valuation, your return increases from $900k to $2.7M, or 3X.

My partner at Blossom Street Ventures, Sammy Abdullah, published a fascinating post last fall which dove into founder equity at exit for publicly traded tech companies. I highly encourage you to read it here but the gist of it is that the average founder(s) ownership of 79 publicly traded companies (Alibaba, Amazon, Apple, Lifelock, Square, and Zendesk to name a few) at exit was 17%. And the median was 11%. Now, you’re probably a ways away from exit, so there will be a few rounds of financing to go through, but keep these numbers in mind as you forecast your future cap tables.

We tell our clients to wish for 15% investor dilution, target 20%, and settle for 25% per round. Thus, if you own 100% of your business on day 1, a typical dilution life-cycle (including a 10% employee pool per round – which would be heavy) may look like this:

(I don’t want to ignore control – as ownership is usually tied to control; but that’s not always the case. I’ll address this in my next post)

As you can see – when done correctly, dilution is not just okay, it’s a good thing. It’s a signal that your company is completing additional financing rounds, which is a great indicator of growth. Focus on the value at exit, not the ownership %, and you should be fine.