Venture in the Middle 2024 Trends

February 26, 2025 | By Kevin Vela

It’s been a bit…but I thought this was a good time to recap a few trends from 2024.

Increase in Pay-to-Play Rounds

In 2024 Vela Wood (VW) facilitated four pay-to-play rounds as company counsel, and reviewed another 12 on behalf of our fund clients. That’s 16 in total, which is at least 10 more than I can remember seeing in the firm’s first 15 years, and we’re currently facilitating another two for company clients. Why the remarkable increase? Let’s discuss.

First of all, let’s identify what a “pay-to-play” round is. A pay-to-play round is a financing round in which existing investors must participate (meaning invest their pro-rata share or a specified amount) to maintain certain rights, usually their preferred stock rights. If they do not participate, they are penalized—typically by having their preferred shares converted into common stock, sometimes via a reverse split (i.e. 10 shares of preferred turn into 1 share of common). The point is to motivate investors (participate or be penalized), and clear preferred stock off the cap table. If investors don’t participate, their preferred shares will be converted into common.

While a new investor can utilize a pay-to-play round to force existing investors to participate so that the existing investors don’t get a free ride (benefit from new dollars to the company without putting in any fresh cash themselves), pay-to-play rounds are frequently led by insiders as a way to save the company.

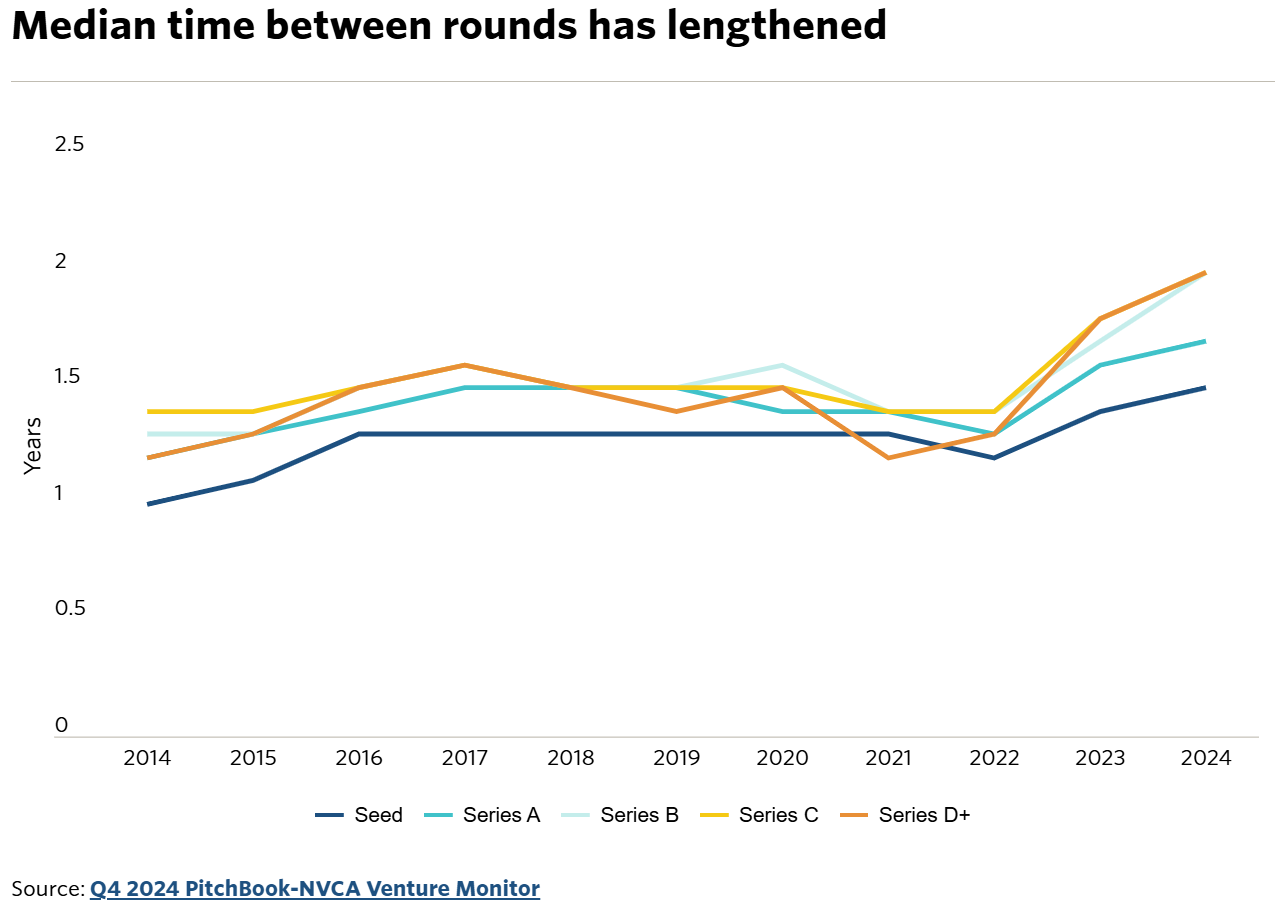

Pay-to-play rounds are almost always only used for down rounds, and the absurd number of them in 2024 seems to indicate a correction in the market. See this recent chart from PitchBook below that supports our firm’s experience. Also note the increased time between rounds, which signals that it’s harder for companies to find investors.

Now that VW has seen so many pay-to-play rounds, I’d like to share a few tips.

For the company – note that pay-to-play rounds are very, very expensive. Much more expensive than a typical financing round. Here is why:

First of all, a company going through a down round probably has not been frequently keeping its law firm apprised of corporate governance items (i.e. option grants and terminations, or Board meeting minutes) so there’s usually a lot of corporate clean-up to do.

Secondly, pay-to-play rounds require a lot of investor communication to inform, prepare, and explain. This adds legal expense.

Finally, the documentation is much more complex because in most pay-to-play structures the company has to convert everyone to common stock first, and then “pull through” the participating investors into existing or newly created classes of preferred stock. This sometimes must be done in multiple steps based on the language and existing rights in the charter.

So what can a startup do? If a company is going to go through a pay-to-play round, don’t just go halfway with it. Yes, it is going to be painful, and you are likely to frustrate some investors. But that’s better than shutting the company down. So go ahead and use this as an opportunity to (i) consolidate the cap table, (ii) reset liquidation preferences, (iii) restructure the board, and (iv) clear out any legacy side letter rights (in general, try not to let those go one for too long).

A good way to structure a pay-to-play round is to establish a class of new preferred equity with a 1.5x – 3x non-participating liquidation preference, which provides a solid return to new and participating investors in the event of reasonable upside and preserves the possibility of a return to all investors in the event of a home run. Furthermore, a refreshed management equity pool, and perhaps cash performance plan, can help to ensure that the key common holders are motivated and have reasonable upside as well.

For the investor – if you are a larger investor, it’s best to participate unless you are ready to write off this investment. This is because the pay-to-play round is likely to create an entirely new liquidation preference that you want to be a part of. If a company is going through a pay-to-play round then the company outlook may be less than great, and the best chance for your return is to be at the top of the capital stack. We have seen a few client companies use a pay-to-play round to get back on track, so they can be valuable when done correctly.

Dexit (Companies Exiting Delaware)

Delaware has long been the preferred state of incorporation for companies due to its business-friendly laws, specialized court system (the Delaware Court of Chancery), and favorable state tax structure. The Court of Chancery has judges who are supposedly business experts, which removes the risk of unsophisticated juries in business litigation. Moreover, the Court of Chancery is a court of equity rather than a court of law. This means it primarily decides cases involving equitable relief (such as injunctions, specific performance, and fiduciary duty claims) rather than awarding monetary damages, typically handled by courts of law. A court of equity focuses on fairness rather than enforcing strict legal rules. The classic law school example is: what if a buyer signs a contract to purchase a rare painting and the seller breaks the contract? How can the buyer recover the painting, not money? A Delaware Chancery Court could enforce specific performance and award the seller the painting, whereas a court of law would be likely to just award monetary damages.

Anyway, Delaware’s perch as the undisputed corporate jurisdiction champ is at risk.

You may have heard recently that Dropbox moved its company’s charter out of Delaware and into Nevada. As did Pershing Square Capital Management. Meta is considering doing the same. This is all in the wake of Tornetta v. Musk where the Court invalidated Elon Musk’s $56B pay package from Tesla in favor of the stockholders, only to see the stockholders approve the package for Musk anyway. Tesla moved to Texas shortly thereafter. All of these heavyweights are moving power away from the Delaware business courts, which some insiders think have been overreaching in recent history, and giving that power back to their Boards.

We are not quite to the point of advising clients to move out of Delaware, but this is certainly on our radar, and we could in the future. We do have a few whom we’ve recently left in Nevada or Texas, when historically we would have moved those clients to Delaware.

I will note that these trends, along with the coming Texas Stock Exchange have us feeling very good about the demand for corporate legal work in Texas for quite some time into the future.

General Early-Stage Venture Trends

We’re going to release our annual venture deals report next month (subscribe to the Vela Wood newsletter to get it sent to you), but 2024 saw a return to normalcy for early-stage ventures. A few key takeaways –

- Safes, specifically Y Combinator Post-Money Safes, are the dominant early-stage financing vehicle in North Texas. They are much more popular than convertible notes, and investor acceptance signals a maturing venture market. (They have been the leader in markets like San Francisco and Austin for years.)

- It’s becoming increasingly rare to see early-stage equity rounds smaller than $2M. Convertible instruments are preferred. Using a Safe for friends and family and pre-seed rounds is more efficient and streamlines future rounds.

- Our US based fund clients are becoming increasingly more comfortable with overseas deals as they look for better value. We facilitated four deals in the UK last year. The UK venture ecosystem uses a set of docs based on NVCA standards, called “BVCA,” and while the vernacular is different from US financings, the themes are the same. Look for more standardization of deal documents across the globe.

In closing, 2024 was still a correction year given all of the pay-to-play rounds, but things look to be normalizing. I still hear from investors that early-stage startup rounds are overpriced, but increased supply from funds (it’s easier than ever to launch a fund, and the proliferation of “SPV” style funds has led to increased investment dollars in the marketplace) continues to prop up valuations.