QSBS Expansion – What You Need to Know

July 8, 2025 | By Kevin Vela

Congress recently passed several significant updates to Qualified Small Business Stock (QSBS) rules as part of the One Big Beautiful Bill.

As you may recall, QSBS provides a powerful tax incentive for investing in early-stage C-Corporations. If certain conditions are met—including holding the stock for a specified period—investors can exclude up to 100% of capital gains from federal taxes, up to the greater of $10 million or 10 times their basis in the stock. This benefit has long been a favorite among angel investors, founders, and early-stage VCs. For more background on how QSBS works and who qualifies, check out our original QSBS primer.

Gross Asset Cap Increased

Under the latest updates, the gross asset limit for QSBS eligibility was raised from $50 million to $75 million. This means a company can now have up to $75 million in total assets (measured just before the stock issuance) and still qualify as a “qualified small business.” The change significantly expands the number of companies that may qualify, especially those raising larger growth rounds.

Gain Exclusion Cap Raised

The per-issuer capital gains exclusion cap was raised from $10 million to $15 million. Meaning, investors can now exclude up to $15 million in gains per issuer—tax-free—if they meet the other QSBS requirements.

Notably, this does not replace the 10x basis rule. Instead, it expands the first prong of the test. The updated rule allows for the exclusion of the greater of:

- $15 million or

- 10x the investor’s basis in the stock

Examples:

- If you invested $1 million in QSBS-qualified stock and held it for the full 5-year period, you could now exclude up to $15 million in capital gains (previously only $10 million).

- If you invested $2 million, then 10× your basis would be $20 million, which exceeds $15 million—so you’d qualify for a $20 million exclusion.

- If you’re a founder who received shares at inception for par value—say $1,000 total—then 10x your basis would only be $10,000. In that case, your cap would now be $15 million, since that is greater than 10x your basis. This is a significant win for founders who qualify for QSBS, as it substantially increases the amount of gain they can exclude despite a very low-cost basis.

Shorter Holding Periods Now Eligible for Partial Exclusion

Historically, you were required to hold QSBS-qualified stock for at least five years to receive any tax benefit. The new rules introduce a tiered exclusion structure for shorter holding periods:

- 3 years: Eligible for a 50% exclusion

- 4 years: Eligible for a 75% exclusion

- 5+ years: Eligible for the full 100% exclusion

For example:

- If you acquired qualified stock in 2026 and sold it in 2029 (3 years later), 50% of your capital gains could be excluded under QSBS.

- If you waited until 2030 (4 years), 75% of gains would be excluded.

- If you held until 2031 or beyond, you’d be eligible to exclude 100%.

Note: To qualify for any QSBS exclusion, the company still must meet the standard QSBS requirements—such as being a C-corp, staying under the $75 million gross asset threshold at the time of issuance, and operating in an active trade or business (i.e., not primarily holding investment assets).

Also important: the shorter holding period rules only apply to stock issued after the date the new law went into effect—they do not apply retroactively.

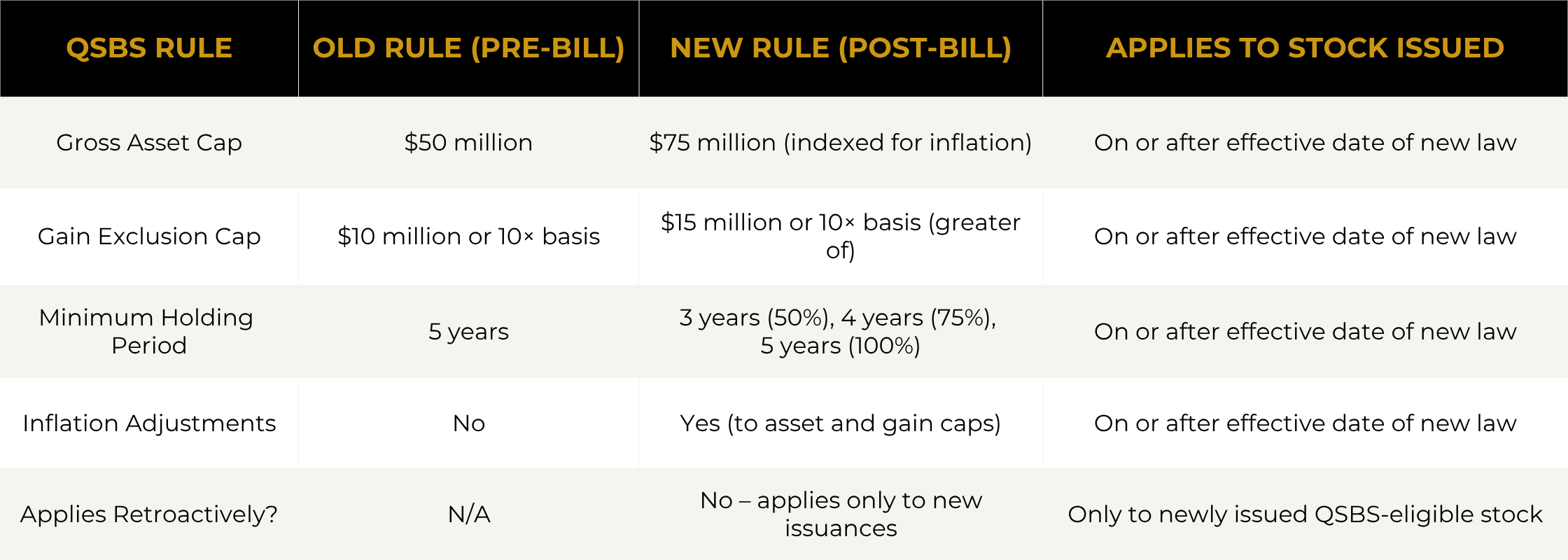

In fact, none of the new QSBS enhancements—including the increased $75M gross asset cap, the $15M exclusion cap, or the inflation indexing—apply retroactively. They only apply to stock acquired after the law’s effective date. Here’s a quick summary of what changed and when it matters:

Inflation Adjustments

Both the $75 million gross asset cap and the $15 million gain exclusion amount will now be indexed for inflation, meaning they will gradually rise over time without requiring new legislation. This provides more flexibility as company sizes and valuations continue to grow.

These updates are now in effect and apply to eligible stock issued after the bill’s enactment. The overall intent of QSBS—to incentivize long-term investment in high-potential small businesses—remains intact, but the expanded rules open the door for more investors and companies to benefit from this powerful tax incentive.

If you’re a founder, angel investor, or VC and want to understand how these changes apply to you, feel free to reach out. We’re happy to help.