How much equity should I grant to advisors?

June 29, 2017 | By Kevin Vela

This blog was originally published in June of 2017 but was revised in October of 2024 and is still accurate.

Note: Issuing stock grants or stock options carries important tax considerations; I’m going to ignore those for now to make this article at least somewhat interesting – but you MUST consult with your attorney and tax advisors before issuing any early-stage equity.

Clients regularly ask a variation of the above question, replacing advisor with CTO, COO, sales manager, front-end engineer, etc. It’s a great question. And one with varying answers and consequences depending on a company’s lifecycle stage. As a founder, one must understand that a company who has completed a late-stage financing round (Series A, Series B, etc.) can’t dispense equity like a fledgling startup can. Why not?

Simple. The company’s value is constantly changing (hopefully increasing). Granting an advisor 10% of a very early-stage company worth $50,000 is only worth $5,000, and the equity will be diluted by every subsequent financing round. Yet, granting an advisor 10% of a company valued at $20,000,000 is equivalent to giving an advisor $2,000,000 (and would lead to tremendous tax consequences, which is why you never really grant stock to advisors, but rather issue stock options – but that’s for another day). To boot, after a Series A round, the company is fairly valuable and a lot of the heavy lifting is completed. Thus, you’d be giving the advisor an exorbitant value for potentially minor contributions to the company’s growth. Not to mention, Series A investors would be pretty disgruntled by an immediate 10% dilution.

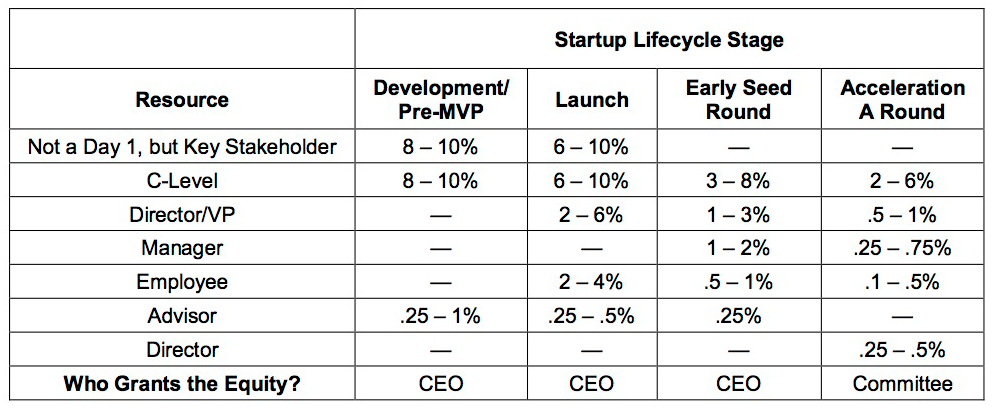

Avoiding the latter consequences are vitally important. So here’s a handy reference chart to use as a jumping off point for distributing early-stage equity:

As demonstrated by the table, the percentages diminish consistently over the life of the company. And, while .5% is not a vast amount of equity, .5% of a $20,000,000 company equals $100,000 dollars in value (ignoring the exercise price). The primary goal of compensation is to attract, retain, and reward key stakeholders, and .5% of a well-funded company should still accomplish these goals.

Notably, the equity in each stage drops anywhere from 33%-50% per stage. This percentage reduction is expected. And granting diminishing amounts of equity as the company grows is a reasonable and responsible decision.

Additionally, CEOs generally make the decision to grant equity in the Development through Early Seed Round stages. But when a company begins the Acceleration A Round stage, these decisions are oftentimes made by a compensation committee composed of the board of directors. To lessen the burden on the CEO and create independent thinking, the compensation committee will create compensation plans and propose the plan to the rest of the board to determine the best course of action.

While every company and situation is different, the figures in the above chart should give companies an idea of the range of early-stage equity issuances to stakeholders. And, hopefully, there will be more fruitful discussions between companies, their stakeholders, and their attorneys determining how much early-stage equity these stakeholders should receive.