Flipping Through PitchBook’s 1Q 2018 VC Valuations Report

August 15, 2018 | By Kevin Vela

Yes, it’s the 1Q (available here). It’s been on my desk for a few months. But I’ve made my way through it and wanted to share a few thoughts.

Let me start with a little background. First of all, this report, sponsored by Deloitte, is fantastic. It’s well done, thoughtful, and insightful. It’s one of many reports that PitchBook puts out each year; in the Venture Category, I believe this particular topic is presented annually. Secondly, this report is based on reported VC deals, which skew toward later-stage and toward the coasts. Please keep that in mind as you read below, especially with the understanding that my viewpoint is heavily influenced by Dallas data first, and Texas data second.

Let’s start with the key takeaways on page 3.

- 19% increase in late-stage median pre-money valuations since 2017. Most of the activity in Dallas is early-stage, but I’m definitely seeing an increase in valuations here locally. For example, a few years ago, anything over $1M had a good chance of being an A round. Now, it’s not uncommon to see a $2M – $4M Seed round in North Texas.

- 1.4 & 1.8 years between Angel & Seed, and early-stage to late-stage, respectively. Generally, the time between rounds gets bigger each round because the companies raise more money and thus have more runway. These gaps feel a little long to me for the deals we see, but that’s because an Angel round is likely to only be a $500k round, not the $1M+ that PitchBook may be reporting.

I’m going to move page by page now and call out a few interesting points.

Late-Stage Valuations Continue to Soar

Page 5 – There’s been a ton of doom and gloom written recently over skyrocketing venture valuations and a shrinking IPO market (where’s the liquidity if there is no IPO? secondaries help a little), and I think those assertions are accurate. I also think that VCs just don’t care and those factors are being built into the risk/return analysis. Also, if you read the text on page 5, there is a line that helps to explain the rising valuations: “the median age for companies receiving financing pushed to three years – twice as old as a decade ago.” Thus the companies are older. Here are two thoughts why companies are waiting longer to raise:

- They can – hardware & software is cheaper and more accessible, so it’s easier to bootstrap, and

- Companies want to wait as long as possible to drive up valuations. They recognize the value in doing so.

Locally, I don’t think that valuations are “soaring,” but I do think they are reasonably increasing. I say “reasonably” because as the Dallas startup ecosystem matures, the companies are smarter, better, and experience a quicker growth curve. The founders are more prepared, the talent they are hiring is stronger, the professional service providers are more industry focused, and the advisors are better. In turn, the companies should have a higher valuation.

Percentage Acquired in Angel & Seed

Page 5 – If you look carefully at the last year of Angel and A, you’ll see that companies are selling more equity early on. I’m seeing that as well in Seed and A rounds as VCs trade more money for lower valuations. By the way, founders, don’t take more money just because the investor is telling you to do so. Be mindful of your dilution, please. Consult with your startup attorney.

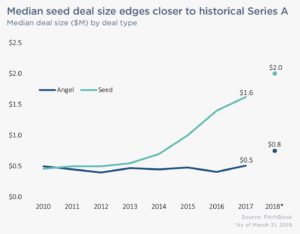

Deal Sizes for Angel and Seed Rounds

Page 7 – These figures are consistent with what we’re seeing here at VW. Note the dramatic rise in Seed investment size since 2014 and the even higher 1Q 2018 numbers. These higher size amounts are a result of more institutional investors participating in early rounds. They have the pocketbooks to do it, and they generally don’t like writing small checks.

Valuation Step-Ups

Page 9 – The overall trendline looks to be pretty flat, but the data itself is very interesting. A 1.5x – 2x step-up in valuation for early-stage valuations is helpful for understanding and forecasting future dilution. Actually, given that dilution is a known variable (~25%), we can back into future valuation as a function of your early valuations.

In conclusion, there are more deals being done, for more dollars, at higher valuations. Increased valuations result from:

- (1) smarter founders (more resources and a larger, accessible knowledge base);

- (2) better companies (easier to build and a larger, accessible knowledge base);

- (3) institutional investors sliding down to earlier stages due to additional LP funds and later stage competition;

- (4) an influx of angel investors as high net-worth individuals become more comfortable with the asset class; and

- (5) more dollars being invested per round (due to (3) and (4)) and a desire to keep the % of equity sold per round somewhat flat.