So, What’s with the Unicorn?

Welcome to Venture Glossary™, where we arm you with the venture startup terminology tools you need. For example, a “Unicorn” is a startup company valued at over $1 billion. Canadian tech unicorns are known as narwhals. A decacorn is a word used for those companies over $10 billion, while hectocorn is the appropriate term for such a company valued over $100 billion.

#

1x

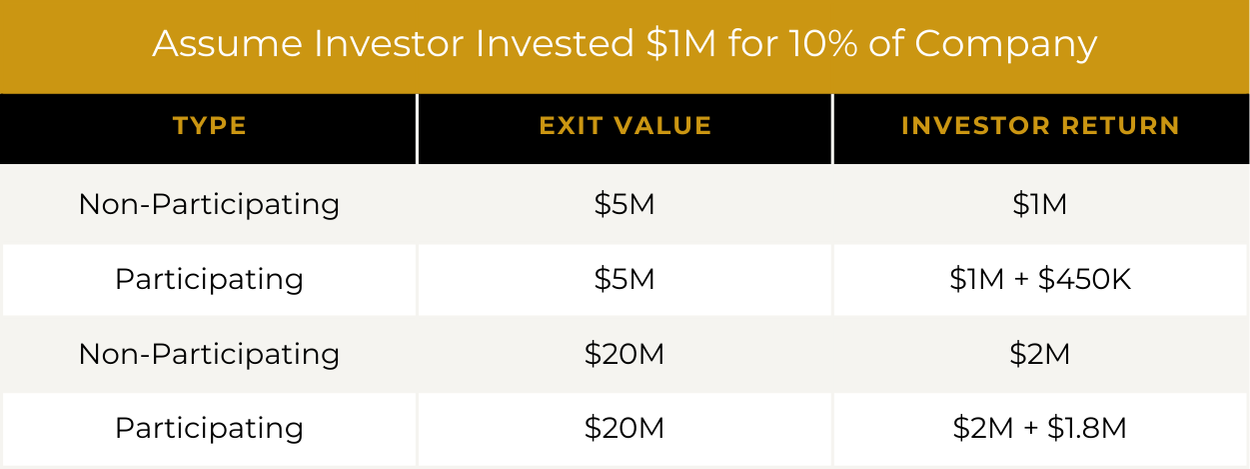

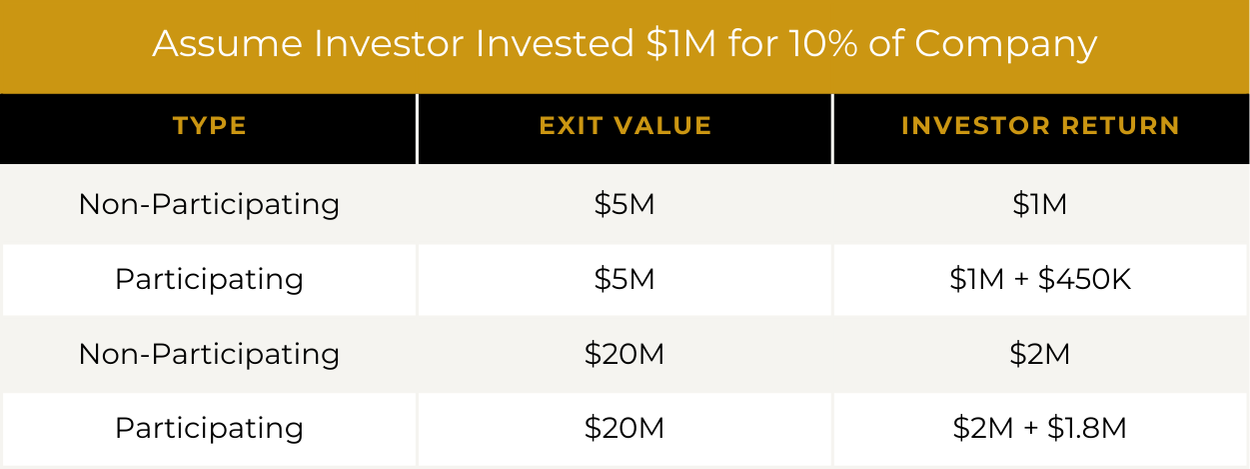

1x means “one times original purchase price” in conjunction with a liquidation preference. Liquidation preferences can be participating or non-participating.

Example:

The VC firm was too aggressive; they wanted a 2x liquidation preference, instead of a 1x.

Copy Link4 Years with a 1-Year Cliff

4 Years with a 1-Year Cliff is the typical vesting schedule used by startups. A one year cliff means that nothing vests for the first year, but after a year the vesting would catch-up to 12/48, and then the remaining balance would vest over three years (typically 1/36 a month for 36 months).

Copy Link409A Valuation

Section 409A of the Internal Revenue Code regulates the treatment of non-qualified deferred compensation to service providers for federal income tax purposes. A company must issue stock options at fair market value in order to legitimately benefit from this section of the code and will typically hire a third-party agency to issue a report determining exactly what that is. The report is commonly known as a 409A valuation and they are critical to issuing stock options for a venture backed company. Most startups order at least one per year, or after a material financing event, whichever is sooner.

Example:

We have to get our 409A valuation completed before we can issue the next round of options.

Copy Link83(b) Election

An 83(b) Election is an election made under the Internal Revenue Code that allows a person receiving shares (or units) under a vesting schedule to recognize income based on the entire value of the shares as of the date of the grant – instead of as the shares vest. Basically, you accelerate the ordinary income taxes. In the context of a startup, the ordinary income liability at the time of the grant is negligible because the value of shares early on is so nominal. You want this. But if you fail to file an 83(b) election, then you will be liable for paying ordinary income taxes on the difference between fair market value and the grant price when the shares vest. If your company’s value is increasing over time, this could be a nasty consequence.

Copy Linka

Accelerated Vesting

Accelerated Vesting is a process whereby a holder of restricted equity has the vesting schedule sped-up, or accelerated, upon the occurrence of certain events, i.e. termination of the holder without cause or a sale of the company.

Copy LinkAcceleration Clause

An Acceleration Clause refers to a contractual clause which allows debt owed over time to be “accelerated” so that it is owed immediately. You see this most often in promissory notes, where a default or breach of a provision of the agreement will cause the entire debt obligation to accelerate and become due immediately.

Copy LinkAccelerator

An Accelerator is a program whose intent is to “accelerate” the development of startups. Typically an accelerator will last one to three months and aims to provide support to startups through small amounts of seed capital, mentoring, training, and events for a finite period. It is common for an accelerator to receive some equity in the participating companies in exchange for the company’s participation in the program.

Example:

We gave up 8% to our accelerator, but once we graduate we’re going to be ready for Series Seed Funding at a $2M valuation.

Copy LinkAccredited Investor

Accredited Investor is defined under the Securities Act of 1933. Anyone (individual or entity) who meets the definition is able to invest in certain private offerings. Simply put, an accredited investor is an individual with a net worth (individually or with a spouse) of at least $1,000,000 exclusive of a primary residence, or who has earned at least $200,000 individually, or $300,000 jointly with a spouse in each of the last two years. There is also a long list of ways that an entity can qualify as an accredited investors.

Copy LinkAcquihire

Acquihire is the acquisition of a company primarily for the talent or employees, and not necessarily the product or service offerings.

Copy LinkAdvisor Agreement

An Advisor Agreement is a formalized agreement between an entrepreneur and a startup advisor that details and defines the relationship. Advisors typically receive a small amount of equity for their services.

Copy LinkAdvisory Board

An Advisory Board is less formal than a startup’s board of directors. An advisory board typically consists of people whose experience, knowledge, and influence can benefit the growth and direction of the startup.

Copy LinkAlpha Testing

Alpha Testing refers to internally testing a pre-production model of a product, typically on a controlled basis, to work out the kinks without anyone else seeing it.

Copy LinkAnalyst (VC Firm)

An Analyst is a very junior person at a venture capital firm, often a recent college graduate.

Copy LinkAngel Financing

Angel Financing refers to a startup’s financing round whereby the investors are angel investors (see Angel Investor). This round typically comes after a Friends and Family round, but before a Series A round. Many Seed and AA rounds are composed of angel investors.

Copy LinkAngel Investor

Angel Investors are individuals who provide seed or startup finance to entrepreneurs. In addition to an investment, angel investors may also provide industry contacts and knowledge.

Copy LinkAnnual Contract Value (ACV)

Annual Contract Value (ACV) is the value of a contract over a 12-month period. A figure like this is important for internal planning, and investors may ask about it if your revenue model includes contracted terms.

Copy LinkAnnual Recurring Revenue (ARR)

Annual Recurring Revenue (ARR) is the amount of revenue a company generates from recurring payments over a year.

Copy LinkAnti-Dilution

Anti-Dilution refers to a right, usually requested by investors purchasing preferred shares, to protection against future rounds whereby securities are sold at a lower price than the current round. There are several types of anti-dilution. See also Broad-Based Weighted Average, Narrow-Based Weighted Average, and Full Rachet.

Copy LinkArticles of Incorporation (AOI)

Articles of Incorporation (AOI) are what some states, including California, call the primary organization document for a corporation. In Texas, it’s called a “Certificate of Formation” and in Delaware it’s called a “Certificate of Incorporation.” Many people just refer to these docs as a corporation’s charter.

More Information:

The Company Agreement Explained: Why Do I Need a Company Agreement If I Have a Certificate of Formation?As-Converted Basis

As-Converted Basis refers to the calculation of securities assuming conversion of all stock.

Example:

This shall require the consent of a majority of the Common Stock shareholders, determined on an as-converted basis.

Copy LinkAsset Acquisition

An Asset Acquisition is a transaction whereby an acquirer purchases the assets of the company, rather than the ownership interests.

Example:

It was more tax favorable for BigCo to purchase the assets of LittleCo, instead of the equity interests.

Copy LinkAssociate (VC Firm)

An Associate is a person at a venture capital firm who is involved in deal analysis and management. The seniority of this position varies by firm, but generally associates need a partner to support their activities.

Copy LinkAt-Will Employee

An At-Will Employee is an employee who does not have an employment agreement and can be terminated by the company for any reason.

Copy LinkAuthorized Shares refers to the number of shares authorized by a corporation, which is the most shares that the corporation can issue. This number is set forth in the corporation’s state formation documents and must be amended when the corporation needs to issue more shares if none are available for issuance.

Copy LinkAutomatic Conversion

Automatic Conversion refers to a term found in convertible promissory notes (same as convertible debt) whereby the note will automatically convert into equity upon the occurrence of certain events, i.e. a next round financing or maturity. Note that automatic conversion into the next qualified financing round is standard; automatic conversion at maturity is generally negotiated (but usually preferred from the company’s standpoint).

Example:

Our convertible notes call for the principal plus interest to automatically convert into the next round whereby the company raises at least $1M.

Copy Linkb

B Corporation

B Corporations are for-profit organizations that use their business to address social and environmental problems. They are not separate legal entities, nor do they have different tax treatment from the basic corporation. Rather, they must comply with extensive certification requirements put in place by the non-profit organization B Lab. After obtaining certification, “B” businesses can differentiate themselves from other businesses and enjoy the marketing advantages and investment opportunities that come with being recognized as a company prioritizing the community and the environment in their daily operations.

Copy LinkBackup Certificate

A Backup Certificate is a certificate delivered by a company to the lawyer or law firm in order to provide factual support for an opinion by the law firm.

Example:

We had to deliver a backup certificate to our lawyers in support of the opinion they wrote about our company to the VC fund.

Copy LinkBalance Sheet

A Balance Sheet is one of the four main financial statements that provides a summary of a company’s finances at a specific point in time. All balance sheets include a company’s assets, liabilities, and equity. Unlike other financial statements, the balance sheet provides an accurate summary only at the time it is created.

Copy LinkBankruptcy

Bankruptcy is a judicial process undertaken when a company is unable to repay its debts. Bankruptcy proceedings are filed under different chapters of the bankruptcy code depending on the the various solutions and outcomes the company hopes to achieve. Some bankruptcies are involuntary actions brought against debtors by creditors.

Copy LinkBenchmark

A Benchmark is a milestone or a goal. Oftentimes, funding or compensation bonuses are tied to benchmarks.

Example:

Part of our funding is contingent on hitting certain benchmarks.

Copy LinkBest Alternative to Negotiated Agreement (BATNA)

A Best Alternative to Negotiated Agreement (BATNA) is a backup plan if no agreement is reached between two parties.

Copy LinkBeta Testing

Beta Testing refers to testing performed by the intended customer, with the goal of getting user feedback on the product.

Copy LinkBlanket Lien

Blanket Lien is a lien over all of a debtor’s assets, which means a creditor can seize any of a company’s assets if the debtor defaults.

Copy LinkBleeding Edge

Bleeding Edge is a term used to refer to a product, service, or technology that is so new and innovative that it is too cutting edge for the term “cutting edge.”

Copy LinkBlended Preferences

Blended Preferences are when a startup has multiple classes of preferred stock and each class has the same rights in the event of a liquidation. When classes or shareholders have equal rights, the equal rights are often called pari passu rights.

Copy LinkBlind Pool

A Blind Pool is a fund where the investor’s funds are committed and delivered up front. Contrast this with a Capital Call fund structure.

Copy LinkBlue Sky Laws

Blue Sky Laws are securities restrictions enacted at the state level, established to protect a state’s investors. These regulations prohibit brokers and investment advisors from recommending, soliciting, or discussing any security with a client unless that security is compliant with the Blue Sky laws of the state that the investor resides in. With startups, the more states they plan to raise money in, the more sets of Blue Sky laws they will have to comply with.

More Information:

Understanding Reg D Exemptions for Raising CapitalSecurities Straight Talk Vol. 4: Why you Need to Consider Blue Sky Laws Before Conducting a Capital Raise

Board Consent

Board Consent is the consent to some company action by the board of directors for actions or transactions that need director approval. Board consent can be effected at a meeting or in writing.

Example:

We have to get board consent before we can move forward with the capital raise.

Copy LinkBoard Observer

A Board Observer has the right to observe or be present at the board of directors’ meetings but cannot vote on matters before the board of directors. It can be valuable to be at board meetings when decisions are made.

Copy LinkBoard of Directors

A Board of Directors is a group of people from outside or inside the company who are elected by shareholders to make long-term, strategic, and broad company policy decisions. Boards can be almost any size, but the most effective boards in startups are often 3-5 people.

Copy LinkBoilerplate

A Boilerplate is a standard provision that appears in every legal document and effectively means the same thing in every document. The provision may be worded differently, but the provision achieves the same result.

Copy LinkBook Value

Book Value is the total assets minus the total liabilities of a company. The book value of an asset, as shown on a balance sheet, is typically based on its original cost minus accumulated depreciation. The book value is used for both accounting and tax purposes.

Copy LinkBootstrapping

Bootstrapping is when co-founders self-fund the startup through their own capital or through sales. The intent is to minimize dilution associated with raising capital from investors.

Example:

Mailchimp and 37Signals are examples of startups that were bootstrapped.

Copy LinkBreak-up Fee

A Break-up Fee is a penalty paid by a potential acquirer to a startup if the potential acquirer backs out of an acquisition. In rare instances, this can also apply in financing rounds.

Copy LinkBridge Financing

Bridge Financing is temporary funding for when a startup is running out of cash and needs an infusion of capital to operate the company until the company can raise permanent capital in the form of equity or debt. Bridge financing is typically a six to twelve-month promissory note that converts to preferred stock. The notes usually give an option to the lender to convert the note at a twenty to twenty-five percent discount from the permanent capital.

Copy LinkBridge Round

A Bridge Round is a round of funding that comes between rounds. Typically, a bridge round can be used to extend a startup’s financial runway as it prepares for a larger round. For example, a startup may not be ready for a Series A round from a product development or valuation standpoint, so a bridge round can be used to bring in capital to get the startup ready for Series A.

Copy LinkBring Down Certificate

A Bring Down Certificate is a signed certificate certifying the company’s representation and warranties are still true as of the date of the certificate. Bring Down Certificates are often used to certify that the representations and warranties made in an agreement are still true at a later closing date.

Example:

Because so much time had passed since the first close, the investor asked for a bring down certificate.

Copy LinkBroad-Based Weighted Average

Broad-Based Weighted Average is an anti-dilution method in which a preferred shareholder’s conversion price (the price by which preferred shares are converted to common shares) is adjusted in a subsequent financing round to a lower price per share. The new conversion price is calculated by multiplying the conversion price by a weighted average rate of the previously issued stock and the new preferred shares. The broad-based formula, as opposed to narrow-based weighted average, includes in the calculation all outstanding common stock on a fully-diluted basis, including convertible securities, warrants, and options.

Copy LinkBrogrammer

Brogrammer (“bro” + “programmer”) is the satirical term for a male software programmer who acts like a frat boy. Stereotypically, a brogrammer, unlike his “nerd” counterpart, is cool, loud, sexist, and likes to party.

Copy LinkBroker-Dealer

A Broker-Dealer is an individual or firm that buys and sells securities or acts as an intermediary for such sales.

Copy LinkBurn Rate

Burn Rate is calculated as monthly revenues less expenses. It is typically negative because expenses are so high for a startup relative to revenues. Burn rates are helpful in measuring how quickly a startup will go through all of its cash.

Example:

Monthly Burn = (cash balance at the beginning of the year minus cash balance at the end of the year)/12

Copy LinkBusiness Plan

A Business Plan is a long document developed by a startup which lays out the blueprint for the startup – including the revenue model, growth plans, market information, and other relevant data. Business plans are not typically requested by investors, but the process of creating one can be useful.

Copy LinkBusiness-to-Business (B2B)

B2B is an abbreviation of “Business-to-Business.” B2B describes a sales strategy with businesses as the primary customer.

Example:

The software developer found that selling directly to consumers would not be as lucrative as a B2B strategy of licensing his software to telephone companies.

Copy LinkBusiness-to-Consumer (B2C)

B2C is an abbreviation of “Business-to-Consumer.” B2C describes a sales strategy with consumers as the primary customer.

Example:

The leather manufacturing company supplemented their B2B strategy with a B2C strategy by opening leather boot stores in rural shopping centers.

Copy LinkBuy-Sell Agreement

A Buy-Sell Agreement is an agreement between co-owners that governs the purchase of one party’s entire ownership share in a business. A buy-sell is typically used in a 50/50 ownership situation as a mechanism to avoid the dreaded deadlock.

Copy LinkBuyout

A Buyout is a takeover action by an outside investor. The investor purchases a controlling interest in the company, “buying out” the current ownership.

Copy LinkBylaws

The Bylaws of a corporation set forth the rules for governing corporate matters.

Copy Linkc

C Corporation (C Corp)

A C Corporation is a legal entity that allows for limited liability. C Corporations are legally considered separate entities from their owners. Income is taxed at the corporate level and is taxed again when it is distributed to owners, potentially resulting in double taxation. Despite the double taxation, C Corporations are the preferred entity for a startup because of familiarity and their ability to scale. That said, a C Corporation is not right for everyone. Consult with your legal and tax advisors regarding the best structure for your startup.

Copy LinkCall Right

A Call Right gives its holder the right to buy a certain number of securities at a certain price before a certain point in time, or upon a certain trigger event.

Copy LinkCapital Account

A Capital Account is a ledger in an LLC which tracks the contributions and distributions to members. Each member’s capital account is oftentimes adjusted by allocations and distributions of the company’s profits and losses.

Copy LinkCapital Call

A Capital Call is a notice from a fund (sometimes a venture fund) to its investors (oftentimes called “LPs” because the investors are frequently limited partners in a partnership structure) that a portion of the investor’s committed capital is due. In a fund with a capital call structure, the investors commit to a certain contribution over time, and the fund “calls” the capital upon certain events. Contrast this with a committed fund.

Copy LinkCapital Commitment

A Capital Commitment is a member or shareholder agreeing to contribute some form of capital to the company.

Copy LinkCapital Gains

Capital Gains is the profit from the sale of an asset or property. Taxes on capital gains are typically much lower than taxes on ordinary income.

Copy LinkCapital Raise

A transaction or series of transactions whereby a startup raises investment dollars (or “capital”) to grow the company. Capital raises can be debt, convertible debt, or equity.

Copy LinkCapital Stack

Capital Stack is the layers of financing in a company or project.

Example:

The Series B preferred shares will be a the top of the company’s capital stack.

Copy LinkCapital Stock

Capital Stock is the shares of stock of a corporation, usually in multiple different classes.

Copy LinkCapital Under Management

Capital Under Management is the amount of money a fund is actively managing. Funds being actively managed are limited to those funds the private equity or venture capital firm is receiving fees for managing. Many firms use the amount of capital under management as an indicator of size of the fund. Also sometimes known as “assets under management.”

Copy LinkCapitalization Table (Cap Table)

A Capitalization Table or Cap Table is a record of the owners of a company and their ownership percentage of the securities issued by the company. It is typically presented in a spreadsheet.

Copy LinkCarried Interest

Carried Interest, also known as “the Carry” and “the Promote” is typically the return to the managers or general partners of a fund. In the context of a venture capital fund, a typical carried interest is 20% with a catch-up provision. What this means is that once the investors’ capital is returned, plus any preferred returns (usually 8-10%), the fund manager then gets all distributable funds until the total distributions are split 80/20 between the investors and managers. Once this hurdle is cleared, funds are typically distributed 80/20 thereafter, meaning for each dollar distributed $.80 goes to the investors and $.20 goes to the managers. The concept of a carry exists in all kinds of fund structures – private equity, real estate, hedge funds – and can vary greatly.

Copy LinkCarveout

A Carveout is an exception from a stated provision in a contract.

Copy LinkCatch-Up

A Catch-Up is the distribution of funds to the managers of an investment entity to “catch-up” on an agreed upon return structure with the fund’s investors. A typical catch-up may be 20% after the investors have been returned 100% of their investment plus some preferred interest. For example, an investor invests $100 with a 10% preferred return. If the manager has a 20% catch-up, the investor would receive the first $110 of proceeds ($100 + $10), and then the manager would receive the next $27.50, so that out of the $137.50 distributed to date, the investor has received 80%, and the manager has received 20%.

Copy LinkCertificate of Formation (COF)

A Certificate of Formation is a legal document that is filed in Texas with the secretary of state to create a corporation, limited liability company, and similar entities. Certificates of formation will contain the entity’s basic information (name, registered agent, office address, share structure, etc.). This is known as a Certificate of Incorporation in Delaware.

More Information:

The Company Agreement Explained: Why Do I Need a Company Agreement If I Have a Certificate of Formation?Texas Secretary of State Business and Nonprofit Forms

Certificate of Incorporation (COI)

A Certificate of Incorporation is a state filing that creates a corporation once filed with the secretary of state. The filing informs the secretary of state about the name the company plans to operate under, whom the state can serve process on (the registered agent), where to mail important documents, and equity classification information.

Copy LinkChange in Control

A Change in Control (or Change of Control) transaction is one whereby the owners of a company prior to a transaction no longer own a majority of the shares after the transaction.

Copy LinkChapter 11

A Chapter 11 Bankruptcy is also know as a “reorganization” because the company is allowed to restructure its debt with the help of a bankruptcy trustee.

Copy LinkChapter 7

A Chapter 7 Bankruptcy is when a company ceases operations and winds down under the direction of a trustee who liquidates all assets and pays off creditors in order of priority.

Copy LinkCharter

Charter is a blanket term that describes a corporation’s primary governing document. In Delaware this document is the “Certificate of Incorporation,” in Texas it’s the “Certificate of Formation,” and in California it’s known as the “Articles of Incorporation.”

Example:

As part of our Series A round, we had to amend and restate our Certificate of Incorporation.

Copy LinkChief Executive Officer (CEO)

The Chief Executive Officer (CEO) is typically the head-honcho of the company. In the context of a startup, “president” and “CEO” are usually synonymous.

Copy LinkChurn Rate

Churn Rate is the loss of future revenue due to the loss of a customer/subscription. There are two types of churn: Gross Churn and Net Revenue Churn.

Gross Churn: MRR lost in a given month/MRR at the beginning of the month

Net Churn: (MRR lost minus MRR from upsells) in a given month/MRR at the beginning of the month

Example:

Our churn rate has dropped considerably ever since we hired that fancy account manager.

Copy LinkCIIAA

A Confidential Information and Inventions Assignment Agreement (CIIAA) is a legal document used to assign all intellectual property (IP) and other proprietary rights created by an employee during the course of their employment to the employer. CIIAAs typically also contain non-disclosure, non-solicitation, and non-competition clauses. CIIAAs are also sometimes known as Proprietary Information and Inventions Assignment Agreements (or PIIAAs).

Copy LinkClass F Common Stock

Class F Common Stock is a founder-favorable class of common stock that provides founders with greater control over the company due to increased voting power in company decisions. The Class F common stock was created by the Funder Founder Institute within the past decade and is not used frequently.

Example:

Our Class F Common Stock allows us to maintain voting control because the founders get 10 votes for each share we own.

Copy LinkClawback

A Clawback is when limited partners take management fees back from general partners in private equity arrangements. Most private equity agreements have clawback provisions that allow for this action after a fund has substantial losses and a general partner has already been compensated for previous significant gains. The general partner is not allowed to keep all of her compensation for gains the fund failed to ultimately achieve.

Copy LinkCliff

A Cliff is a term used to describe the length of time it takes for stock options or other securities on a vesting schedule to partially or fully vest.

Example:

A typical vesting schedule for a startup is monthly over 4 years, with a one-year cliff. This means that the recipient of the equity will receive nothing for the first year, then 25% after the first year, and then the remaining 75% will vest monthly over 36 months.

Copy LinkClosing

A Closing is the date, sometimes specific time, and process by which a transaction will be completed.

Copy LinkCo-Investment

Co-Investment is when both limited and general partners circumvent the fund and invest in an operating company in the fund’s portfolio rather than investing in a holding company through the private equity fund.

Copy LinkCo-Sale

Co-Sale is a contractual right allowing a shareholder to sell his shares at the same time as a majority shareholder. The shareholder with the right receives the same terms as the majority holder. Often called a Tag Along Right.

Copy LinkCockroach

A Cockroach is a startup that builds slowly and spends carefully, minimizing risk so that it can survive doomsday scenarios and live to fight another day. A Cockroach isn’t as attractive as a Unicorn, but it is more likely to survive lean times, and it sees lack of resources as a challenge to find creative solutions.

Copy LinkCohort

Cohort is a term used by VCs when analyzing customer data. A group of customers (i.e. customers acquired in a certain month) comprise a cohort and are then tracked against other cohorts.

Example:

Our December 2015 cohort is spending much more per month than our December 2016 cohort. We should drill in on why.

Copy LinkCold Introduction

A Cold Introduction is a self-made introduction. While less optimal than a warm introduction, anyone seeking to raise venture capital will have to master the art of the cold introduction.

Example:

A cold introduction can take the form of a carefully crafted LinkedIn message or email, a phone call, or an in-person attempt to initiate a conversation.

Copy LinkCollateral

Collateral is a debtor’s asset that the debtor allows a creditor to have rights to until the debtor’s obligations are satisfied. A company can grant collateral in any of its assets, but most often collateral is granted in inventory or equipment.

Copy LinkCommitment Period

A Commitment Period is the length of time a VC fund has to find and invest in new companies, usually five years.

Copy LinkCommitted Fund

A venture fund that collects all investments from its investors (oftentimes referred to as “limited partners” or “LPs”) up front, as opposed to a one deal at a time or capital call structure.

Copy LinkCommon Stock

Common Stock is an equity ownership in a company. Common stock is typically issued before any other type of equity. Once a company has raised capital, common stock typically has junior liquidation and distribution rights to other stockholders and creditors.

Copy LinkCompany Agreement

A Company Agreement is an internal document for an LLC that provides the framework for how a limited liability company operates. According to the TBOC, “It governs the relations among members, managers, and officers of the company, assignees of membership interests in the company, and the company itself; and other internal affairs of the company.”

More Information:

We've got a whole series in our blog dedicated to breaking down company agreements.Company Record Book

A Company Record Book is also called a Corporate Record Book. Simply, it is a book that houses your important company documents. In the old days, companies kept a three-ring binder with this important information. Today, it’s common to house this information electronically. It’s imperative to keep your corporate records in one place to share with your legal and tax advisors, as well as with investors from time to time.

Copy LinkCompounded Monthly Growth Rate (CMGR)

Compounded Monthly Growth Rate (CMGR) is a calculation that helps investors measure the periodic growth on an investment over a certain period of time. The calculation for CMGR = (Latest Month/ First Month)^(1/# of Months) -1].

Copy LinkConditions Precedent

Conditions Precedent are conditions that must be satisfied prior to a financing or closing.

Copy LinkConditions Subsequent

Conditions Subsequent are conditions that must be satisfied after a financing or closing.

Copy LinkConsideration

Consideration is the benefit that both parties get in a contract. In order for a contract to be binding, there must be consideration on both sides. Consideration can be something you will do, or something you will not do.

Copy LinkConsumer-to-Business (C2B)

Consumer-to-Business (C2B) is a business model where consumer input dictates the terms of the deal they receive from a business. This can come in the form of consumers giving feedback on a product or bidding for their desired price.

Example:

Everlane, an online clothing company, supplements its traditional B2C model with a C2B opportunity for its customers to name the price that they pay on certain items. In addition, Instagram influencers provide C2B services by leveraging their popularity and great photographs for the benefit of large corporate sponsors.

Copy LinkContingent Liability

Contingent Liability is a liability that is not certain, but could arise based on certain events. For example, if a startup is seeking capital during an ongoing lawsuit, the startup would need to disclose the lawsuit as a contingent liability in financing docs.

Copy LinkControl

Control terms are terms that allow a VC to exert positive or veto control in a deal.

Copy LinkConversion Discount

A Conversion Discount is when the holder of a convertible note has a right to convert into a subsequent financing round or transaction at a “discount” to the price per share of that round.

Copy LinkConversion Price Adjustment

A Conversion Price Adjustment is the adjustment to the conversion price of a preferred series of shares upon the occurrence of certain events. It is typically an anti-dilution right.

Copy LinkConversion Rights

Conversion Rights are the rights of a preferred stockholder to convert preferred stock into common stock.

Copy LinkConvertible Debt

Convertible Debt is an alternative to equity fundraising. The investor “lends” the startup money at a reasonable interest rate and with a maturity date in the 12-24 month range (usually). The understanding and intent of the investor and company is not for the startup to repay the debt, but rather for that debt to convert into equity at a discount to the next round. A convertible debt round typically includes a Convertible Note and a Convertible Note Purchase Agreement.

More Information:

Term Sheets 101: Convertible Debt vs. EquityTerm Sheets 101 Podcast

Questions from Last Night’s TeXchange Q&A

Convertible Note

A Convertible Note is short-term debt that converts into equity, typically in conjunction with a financing round. By using a convertible note, the investor would be loaning money to a startup, and instead of a return in the form of principal with interest, the investor would receive equity in the startup.

Copy LinkConvertible Promissory Note

See Convertible Note.

Copy LinkConvertible Security

A Convertible Security is a security that may convert into another kind of security in a company. See Convertible Note.

Copy LinkConvertible Stock

Convertible Stock is stock that converts into another class or series of stock, typically preferred stock that converts into common stock.

Copy LinkCorporate Governance

Corporate Governance is the manner in which an entity is governed and regulated. The term is used across all entity types – corporations, LLCs, and partnerships. Corporate governance documents include the certificate of formation/incorporation and bylaws for a corporation, and the certificate of formation and company agreement (or operating agreement) for an LLC.

Copy LinkCorporate Resolution

A Corporate Resolution is a document that sets forth the actions of a corporation’s board or shareholders. In the context of an LLC, it may simply be called a “resolution.” A certain level of consent is required for a resolution to be approved.

Copy LinkCorporate VC

A Corporate VC is the VC arm of an operating company. Google Ventures is a well known Corporate VC. Their investments are typically strategic in nature and can act as early-stage R&D.

Copy LinkCovenant

A Covenant is a binding agreement to act, or refrain from acting, on some legal right. If a company agrees to refrain from acting on its legal right, the covenant is called a negative covenant. Companies can be faced with civil penalties for breaking a covenant.

Copy LinkCoworking

Coworking is when you are working out of a shared office space with other startups. Examples include The DEC, Common Desk, WeWork, The Grove, and WERX.

Copy LinkCram Down Round

A Cram Down Round is a financing round where new investors receive favorable contractual terms that significantly reduce (dilute) previous investors ownership percentages and rights. Typically, to receive these terms, the new investors must invest substantial amounts of money.

Copy LinkCross-Fund Investment

A Cross-Fund Investment is when a venture capital firm operates more than one fund and more than one fund invests in the same company.

Copy LinkCrowdfunding

Crowdfunding is funding projects through the collective efforts of a number of unrelated individuals. Crowdfunding can be reward-based, equity-based, or debt-based.

Example:

Startup Co-Founder 1: Do you think people will be interested in our business to the point that we can raise capital through crowdfunding? Startup Co-Founder 2: If Kanye West can raise thousands of dollars online to help him out of a $53 million debt through what was essentially crowdfunding, I’m sure we can manage to raise some capital through it.

Copy LinkCryptocurrency

A digital currency built on the blockchain framework that provides a decentralized and transparent ledger of all transactions of the currency. Bitcoin and Ether are examples of cryptocurrencies.

More Information:

Does your company’s ICO need to be registered with the SEC as a securities offering?Cumulative Dividend

A Cumulative Dividend for a preferred stock is when its holders have a right to accrued dividends before common stockholders are paid any dividends.

Copy LinkCumulative Voting

Cumulative Voting is a type of voting system that helps strengthen the ability of minority shareholders to elect a director. This method allows shareholders to cast all of their votes for a single nominee for the board of directors when the company has multiple openings on its board.

Copy LinkCurrent Ratio

Current Ratio is a measurement of a company’s ability to pay obligations determined by dividing the company’s current assets by its current liabilities.

Copy LinkCustomer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the cost to acquire a new customer. CAC can be calculated by dividing the total costs associated with acquisition by the total new customers, within a specific time period.

Copy Linkd

Daily Active Users (DAUs)

Daily Active Users (DAUs) are distinct users who engage with a platform in a given day. DAUs are an important gauge of success for any online business. Businesses often measure Weekly Active Users (WAUs) and Monthly Active Users (MAUs) as well.

More Information:

HBO's 'Silicon Valley' nailed something that lots of real-life tech startups get wrong (Business Insider)Data Room

A Data Room is an online repository of company docs. Typically, a startup will create a data room of relevant company docs to share with potential investors. This is preferred to emailing out docs because the startup can keep them all in one place and update them as necessary. The company can also password protect the data room in order to limit access.

Copy LinkDate of Issue

The Date of Issue is the date that the securities (shares or units) are issued to an investor.

Copy LinkDeal Flow

Deal Flow is the flow of potential deals to an investor.

Copy LinkDebt Financing

Debt Financing is raising money for working capital or capital expenditure through some form of a loan.

Copy LinkDebt-to-Equity Ratio

The Debt-to-Equity Ratio is a debt ratio used to measure a company’s financial leverage, calculated by dividing a company’s total liabilities by its stockholders’ equity. The D/E ratio indicates how much debt a company is using to finance its assets relative to the amount of value represented in shareholders’ equity.

Copy LinkDeck

See Pitch Deck.

More Information:

Who’s Drafting Your Pitch Deck?Startup Pitch Tips (Part 1)

Startup Pitch Tips (Part 2)

Default

Default is when a company is unable to perform the obligations it agreed to in a loan agreement. Which failures by the company constitute default and which rights creditors have upon default vary from agreement to agreement. Often, default is failure to make payments on a loan.

Copy LinkDelaware General Corporation Law (DGCL)

DGCL is Delaware General Corporation Law. These statutes govern corporate law (including LLCs) in Delaware.

More Information:

Anonymity in DelawareDo I really owe Delaware $75,000??? Explaining Delaware Franchise Tax Calculations.

Demand Registration Rights

Demand Registration Rights are rights that give an investor the right to force a company to register its shares for sale to the public. These rights are typically contained in Series A and later financing rounds.

Copy LinkDemo Day

Demo Day is “pitch day,” or when startups in an accelerator pitch to investors.

More Information:

Who’s Drafting Your Pitch Deck?Presenting to Investors: Conciseness = Clarity

Startup Pitch Tips (Part 1)

Startup Pitch Tips (Part 2)

Depreciation

Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life.

Copy LinkDilution

Dilution is the reduction in ownership percentage of a share of stock caused by the issuance of new stock.

Copy LinkDirector

A Director is an elected or appointed person who sits on the board of directors and helps the corporation to make certain decisions. Typically the board of directors is responsible for setting the strategic direction of a company.

Copy LinkDirectors and Officers’ (D&O) Insurance

Directors and Officers’ (D&O) Insurance is insurance purchased by a company to protect its directors and officers from claims arising out of company activities or to indemnify them for such claims.

Copy LinkDisruptive Technology

Disruptive Technology is a business that completely changes the way an industry operates, such as Uber and Lyft for taxis and Amazon for retail.

Copy LinkDistributed Technology

Distributed Technology is a decentralized technology system where the computing and pertinent data is spread across multiple locations and connected by a network. Because of the decentralization, the system does not have a single point of failure and tasks can be completed faster.

Example:

Blockchain is a common application of distributed technology because each computer involved contains a ledger to record and verify every transaction.

More Information:

Does your company’s ICO need to be registered with the SEC as a securities offering?Distribution

Distribution is a payment by a company to its shareholders (or members in the context of an LLC).

Copy LinkDividend

A Dividend is a payment made by a corporation to its stockholders. Dividends can be paid in cash or stock. Startups rarely, if ever, pay dividends.

Copy LinkDouble Trigger Acceleration

Double Trigger Acceleration is the partial or full acceleration of vesting of an employee’s options or stock based on the occurrence of two distinct events. Most typically, the two events are the sale of the company and the involuntary termination of the employee.

Copy LinkDown Round

A Down Round is a round of financing when the startup is at a lower valuation than the valuation placed upon the startup by earlier investors.

Copy LinkDrag Along Rights

Drag Along Rights are the rights of majority investors who are selling their equity in the company to force minor investors to sell their equity interest as well.

Copy LinkDrive-By VC

Drive-By VC is a term used to describe VCs who usually just make investments and do not offer other support or guidance.

Copy LinkDry Powder

Dry Powder is the amount of money that a VC or investor has available to make investments.

Copy LinkDue Diligence

Due Diligence is the process an investor goes through prior to making an investment in a company. This typically includes meeting and interviewing the founders and key stakeholders, reviewing company documents and financials, and interviewing customers, when applicable.

Copy Linke

Early-Stage Financing

Early-Stage Financing refers to investments that happen early in a company’s lifecycle.

More Information:

Do You Really Need That Much Money Now?Keep Your Early Rounds Small, Your Valuation Reasonable, and Close Quickly

Earnings Before Interest and Taxes (EBIT)

Earnings Before Interest and Taxes (EBIT) is an operating profit metric. The EBIT is determined by excluding interest and taxes from expenses and then subtracting those expenses from revenues. Companies’ values are often projected as multiples of EBIT.

Copy LinkEarnings Before Interest, Tax, Depreciation and Amortization (EBITDA)

EBITDA is essentially net income with interest, taxes, depreciation, and amortization added back to it.

Copy LinkEarnout

An Earnout is a portion of a sale agreement whereby the sellers receive certain payments contingent on future events, typically revenue or profit milestones.

Copy LinkElevator Pitch

An Elevator Pitch is a brief description of a startup. It should be brief enough to be delivered during an elevator ride.

Copy LinkEmployee Retirement Income Security Act (ERISA)

The Employee Retirement Income Security Act (ERISA) sets minimum standards for certain pension and health plans to protect the retirement assets of American employees.

Copy LinkEmployee Stock Option Plan (ESOP)

An Employee Stock Option Plan (ESOP) is a company issued plan that allows a company to grant options to its employees and service providers.

Copy LinkEmployer Identification Number (EIN)

An Employer Identification Number (EIN) is the number issued by the IRS to a company that identifies the company as a taxpayer in the US. An EIN is required for a company to open up a bank account and file taxes.

Copy LinkEnterprise Value (EV)

Enterprise Value (EV) is a valuation measurement determined by the sum of the long term debt of a company and its common stock’s market value, minus cash the company has on hand.

Copy LinkEntrepreneur in Residence (EIR)

An Entrepreneur in Residence (EIR) is an entrepreneur with significant startup experience who spends time with startups or companies to lend perspective and guidance.

Copy LinkEquity

Equity broadly refers to the ownership of a company, which can be represented by stock or other units of ownership. When an investor has ownership of a company, he or she has equity in the company.

Copy LinkEquity Crowdfunding

See Crowdfunding.

Copy LinkEquity Financing

Equity Financing is the direct investment by investors in exchange for ownership (equity).

Copy LinkEscrow

Escrow describes documents, funds, and/or other assets being held by a third party until the parties of the transaction have satisfied certain obligations.

Copy LinkEscrow Cap

An Escrow Cap is the amount of money in a merger that is set aside to remedy breaches of the merger agreement.

Copy LinkEvergreen Fund

Evergreen Funds are investment funds with an indefinite life that allow for returns to be re-invested back into the fund instead of distributed to the investors.

Copy LinkExecutive Managing Director (VC Firm)

An Executive Managing Director is a senior partner in a venture capital firm who is superior to a managing director or general partner.

Copy LinkExecutive Summary

An Executive Summary is a short summary document, normally one to three pages, that describes material facts and strategies of a company.

Copy LinkExercise Price

The Exercise Price is the price per share at which an option is exercised, i.e. the price at which the option holder can buy or sell the underlying security. See Exercising Stock Options.

Copy LinkExercising Stock Options

Exercising Stock Options means the option holder purchases the underlying stock, at the exercise price, in accordance with the option agreement.

Copy LinkExit Event

An Exit Event is an event where founders and early investors can sell their interest in a company for cash. An exit can be an initial public offering (IPO) or an acquisition by another company.

Copy LinkExit Strategy

An Exit Strategy is a company’s plan to sell the company or undergo an initial public offering once the company has reached a certain level of success.

Copy Linkf

Face Value

Face Value is the dollar value (or the nominal value, the stated value) of a security (i.e. a share of stock, a bond, etc.). Face Value is rarely the market value of the security. For stock, face value is synonymous with par value, the original price of the stock. For bonds, face value is the amount to be paid upon reaching maturity.

Copy LinkFair Market Value

Fair Market Value is the price that a reasonable third-party would pay for a given asset in the open market.

Copy LinkFamily Office

A Family Office is a high-net-worth private wealth management firm for families. The firms typically provide investment advice but also provide creative ways to structure the family’s’ wealth to prevent losses.

Copy LinkFiduciary Duty

Fiduciary Duty is the legal and ethical duty that an individual has to an entity, which includes the duty of care and the duty of loyalty.

Copy LinkFinder

A Finder is an individual who facilitates transactions, whether acquisitions or M&A, between companies and other parties.

Copy LinkFinder’s Fee

A Finder’s Fee is a commission paid to a third-party for facilitating successful transactions, whether acquisitions or M&A, between a startup, investors, or potential partners.

Copy LinkFlat Round

A Flat Round is a round of financing with the same post-money valuation as that of the previous financing round.

Copy LinkFollow-On Financing

Follow-On Financing is additional funding raised to supplement a startup’s first round of financing and to support business development and growth.

Copy LinkForeign Corrupt Practices Act (FCPA)

The Foreign Corrupt Practices Act (FCPA) makes it unlawful for U.S. companies and individuals to offer anything of value to foreign officials in order to build or retain business.

Copy LinkForeign Qualification

Foreign Qualification is permission by a foreign state (a state outside of the state where the company was formed) for a company to transact business in the foreign state. If a company transacts business in a state without being qualified, the company may lose some of its rights in the foreign state.

More Information:

For more information, or to register as a foreign entity doing business in Texas, visit the Texas Secretary of State's official websiteForm 10-K

Form 10-K is an annual performance report which must be filed with the Securities Exchange Commission. The 10-K provides extensive information regarding the company’s business and financial condition, which includes audited financial statements.

Copy LinkForm 2553

Form 2553 is a form that companies must file with the SEC to be designated as an S-corporation and to receive the taxation benefits of S-corporation status (pass through taxation). The company will not be granted pass through taxation for the current fiscal year if Form 2553 is not filed within the first three months and fifteen days of a fiscal year.

Copy LinkForm 8-K

Form 8-K is a report that publicly traded companies must file when a major event happens within the company. The Form 8-K must be filed with the Securities Exchange Commission, and it is designed to give shareholders and the Securities Exchange Commission notice of the major event. These major events include a CEO change, merger, acquisition, or bankruptcy.

Copy LinkForm D

Form D is an SEC filing form used to file a notice of an exempt offering with the SEC. The exemption is found under Regulation D of the SEC. Form Ds are serious stuff; make sure you’re discussing with your attorney.

Copy LinkForm S-1

Form S-1 is an SEC disclosure form that provides general information and risk disclosures about the company. The company may not undergo an initial public offering if it has not filed Form S-1.

Copy LinkForm S-2

Form S-2 is an SEC form that is used when selling securities to the public, and it is less burdensome than most SEC forms because it applies previously filed information. The SEC allows the forms to be used by companies that have previously registered securities and fully complied with the Securities Exchange Act of 1934 for three consecutive years.

Copy LinkForm S-3

Form S-3 is an SEC security registration form that is less onerous than other SEC registration forms because it cannot be filed unless the company has registered securities with the SEC previously and complied with the Securities Exchange Act of 1934’s reporting requirements regarding the securities previously registered.

Copy LinkForm S-4

Form S-4 is an SEC registration form designed to provide disclosures after companies merge with, acquire, or are acquired by another company.

Copy LinkFounder

A Founder creates or participates in the formation stage of a startup. Founders receive the startup’s initial shares in return for a capital contribution or services provided to the company.

Copy LinkFounders Stock

Founders Stock refers to equity granted to a founder when the company is formed. The equity typically has a par value that is next to nothing and a four year vesting schedule.

Copy LinkFree Cash Flow

Free Cash Flow is a financial metric illustrating cash that the company has on hand to fund the growth of the company or distribute to security holders.

Copy LinkFreemium

Freemium is the free, core version of an app as opposed to the premium, paid version of the app, which generally has fewer or no ads and more features.

Copy LinkFreeze Out

A Freeze Out occurs when a majority of shareholders prevents minority shareholders from receiving dividends or making decisions within the company, leaving minority shareholders with little choice but to sell their shares.

Copy LinkFriends and Family Round

A Friends and Family Round is the first round of funding for a company that consists of obtaining capital from founders’ friends and family.

Copy LinkFrothy

Frothy is used to describe a market that has become overvalued thanks to skyrocketing demand. A Frothy market is characterized by rampant investor speculation on future values.

More Information:

The Man Who Made Apple Famous On The Danger of Frothy Startup Narratives (Fast Company)Full Ratchet Anti-Dilution

Full Ratchet Anti-Dilution is a shareholder protection provision that prevents early shareholders who have the protection from being diluted by later down rounds. If the company has a down round, the price the original shareholder paid for its securities is reduced to match the price paid by the investors in the down round. Full ratchet is a great provision for a shareholder who gets the right, but full ratchet may end up causing more harm than good due to pushback from other shareholders who do not enjoy the right. It typically only is appropriate in a pay-to-play or distressed situation.

Copy LinkFull-Stack Venture Capital Firms

Full-Stack Venture Capital Firms are venture capital firms that employ many people beyond deal professionals, such as marketing, operations, PR, engineering, and financial executives, to attempt to help companies more than traditional VC firms.

Copy LinkFully-Diluted Basis

Fully-Diluted Basis is the total number of shares that would be outstanding if all securities that could convert into shares, such as convertible notes, options, warrants, and preferred shares, converted to common stock. Investors oftentimes want to know what their ownership will look like on a basic and a fully-diluted basis.

Copy LinkFund

A Fund is an investment entity formed to collect many investors’ investments and then invest for the investors. The fund can invest in companies and in amounts that the investors individually cannot, allowing for diversification and potentially greater returns.

More Information:

Read more about Fund involvement in the Dallas startup community by clicking here.Fund of Funds

A Fund of Funds is an investment portfolio composed of only other investment funds, rather than investments made into stocks or other companies.

Copy Linkg

Gamify/Gamification

Gamification occurs when real-world activities are made game-like in order to motivate people to achieve goals. Gamification leverages people’s natural tendencies for competition and achievement. Examples include rewarding users for achievements and earning badges.

Copy LinkGeneral Partner (GP)

A General Partner (GP) is a partner in a partnership. In limited partnerships, there are general partners, who manage the day-to-day operations of the partnership, and limited partners, who invest in the partnership but are not allowed to control the day-to-day operations or they risk becoming a general partner. Unlike limited partners, general partners do not have limited liability. Thus, funds that use a limited partnership structure often have general partners that are LLCs or other limited liability entities.

Copy LinkGeneral Partner (VC Firm)

A General Partner is a senior partner in a venture capital firm.

Copy LinkGeneral Partnership

A General Partnership is the default entity under most jurisdictions. When two or more entrepreneurs join together to operate a business, they have wittingly, or unwittingly, formed a general partnership. There is no need to file any document with the state to formalize or legitimize their undertaking. You want to avoid a general partnership.

Copy LinkGeneral Solicitation

General Solicitation is a company or fund publicly advertising its securities. General solicitations offer the potential to reach more investors. However, general solicitation may cause the company to have to comply with more stringent security registration requirements at the state and federal levels.

More Information:

To learn when General Solicitation is permissible in certain SEC registration exempt offerings see page two of our Private Offering Exemptions Chart here.How Lifting the Solicitation Ban Benefits Startups

Generally Accepted Accounting Principles (GAAP)

Generally Accepted Accounting Principles (GAAP) are mandatory financial accounting procedures and methods that public companies must comply with when reporting their financials. Private companies are not required to use GAAP as their accounting method, but many do.

Copy LinkGoing Concern

A Going Concern is an accounting term for companies that have reached a point of viability where they can continue operations indefinitely with the resources the company has.

Copy LinkGolden Handcuffs

Golden Handcuffs are financial incentives for founders and/or key employees to prevent a departure from the company before some predetermined date or milestone through stock options vesting or bonuses that are only received after the predetermined date.

Copy LinkGolden Parachute

A Golden Parachute is a large severance package given to executives of a company if the executive is forced to resign or is terminated after a merger or acquisition of the company.

Copy LinkGP Commitment (VC Fund)

A GP Commitment is the amount of money, usually between 1% and 5% of the fund, that the general partners invest in their own fund.

Copy LinkGross Profit

Gross Profit is the profit a company makes after deducting the costs associated with making and selling products and/or providing services.

Copy LinkGrowth Hacker

A Growth Hacker is someone whose job is to figure out ways to grow the company.

Copy LinkGrowth Stage

The Growth Stage generally begins once the startup is generating revenues and is now investing more in marketing and user acquisition than in product development.

Copy Linkh

Haircut

A Haircut is either the difference between the purchase price and sale price of an asset, or the market value and collateral value of an asset.

Copy LinkHard Launch

A Hard Launch is when a business debuts its product with a lot of fanfare and publicity, sometimes at a big event or conference. Also known as a Big Bang Launch.

Copy LinkHarvest Period

Harvest Period is the time period in a venture fund’s life where the fund is focusing on “harvesting” its portfolio companies, or helping them grow. It usually comes after the fund is done making investments.

Copy LinkHedge Fund

A Hedge Fund is an investment vehicle that pools accredited and institutional investors’ money to invest in aggressive and complex positions that will provide an active return to the investors.

Copy LinkHockey Stick Chart

A Hockey Stick Chart is a line chart in which a sharp increase or decrease occurs over a period of time. Hockey Stick refers to the shape of a graph showing a dramatic increase or decrease in revenue.

Copy LinkHoldback

A Holdback is a portion of the purchase price that a purchaser does not immediately give to the seller upon closing in order to ensure that there are no post-closing issues with any of the representations and warrants of the seller. See Holdback Escrow.

Copy LinkHoldback Escrow

A Holdback Escrow is a portion of the purchase price that a purchase does not immediately give to the seller upon closing to ensure that there are no post-closing issues with any of the representations and warranties of the seller. The purchaser places the holdback escrow in a third-party escrow account until the holdback period has elapsed and the representations and warranties made by the seller have not been deemed breached, and at which point the holdback escrow is released to the seller. The holdback escrow amount is usually a percentage of the total purchase price.

Copy LinkHolding Company

A Holding Company is an entity created for the purpose of owning entities and assets.

Copy LinkHolding Period

A Holding Period is the amount of time that a person or entity owns an asset or security.

Copy LinkHome Run

A Home Run is when a business has an exit that returns 20 or more times what its investors initially put in.

Copy LinkHostile Takeover

A Hostile Takeover is the takeover of a company without the approval of the board of directors and is usually accomplished by either the purchase of a controlling interest in the company and/or the voting in of a new board of directors.

Copy LinkHurdle Price

The Hurdle Price is the price associated with an incentive unit in an LLC. Incentive unit holders are entitled to distributions only when each non-incentive unit holding member of the company receives distributions per unit in an amount equal to the hurdle price.

Copy LinkHurdle Rate

The Hurdle Rate is the minimum rate of return required by an investor in order for a fund manager to collect management fees.

Copy Linki

Illiquid

A security or asset is Illiquid if there is not a ready market to sell the security for cash.

Copy LinkIn-Kind Distribution

An In-Kind Distribution is a distribution to investors made in the form of securities or other property when a company is unable or unwilling to distribute cash.

Copy LinkIncentive Stock Option (ISO)

An Incentive Stock Option (ISO) is a type of stock option typically granted to founders or key executives. ISOs receive long-term capital gains treatment if the shares are held for more than a year from the date the shareholder receives the options, as opposed to when the options are exercised. Also, the shareholder is not taxed until the options are exercised, as opposed to when the options are received.

Copy LinkIncentive Unit Plan

An Incentive Unit Plan is used by an LLC to incentivize and compensate service providers to the company, similar to a Stock Option Plan in a corporation. An incentive unit gives the recipient a right to the future profits of the company after the date of the grant (hence, incentive units are also known as “profits interest”).

Copy LinkIncorporation

Incorporation is the act of incorporating a company through filing a required document with the secretary of state and paying an incorporation fee.

More Information:

The Company Agreement Explained: Why Do I Need a Company Agreement If I Have a Certificate of Formation?Anonymity in Delaware

Incubator

An Incubator is an entity designed to develop business ideas and/or new technology to the extent they become attractive to venture capitalists. An incubator typically provides physical space and some or all of the services needed for a business idea to develop.

Copy LinkIndemnification

Indemnification is compensation for a harm the company may not have caused but had to pay for. Generally, a third party is harmed and a company must pay the third party for wrongful acts committed by another party. The party who caused the harm must compensate the company for the money the company paid to the third party.

Copy LinkIndemnification Cap

An Indemnification Cap is the maximum amount that a company in a contract may have to pay to another party to the contract for the company breaching one or more representation and warranty provisions in the contract. These caps are typically present in a sale or purchase agreement.

Copy LinkIndemnity

Indemnity is a company’s agreement to pay another party’s losses under a contract regardless of whether the company caused the losses.

Copy LinkIndependent Contractor

An Independent Contractor is a service provider under a contract, but unlike employees, the independent contractor controls how the service is performed. Whether the service provider controls the performance and is an independent contractor or whether the service provider does not have control over the performance is determined using a factored analysis in most states. Some of these factors are how the service is performed, when the service is performed, what tools are used to perform the service, who provides the tools, and what workers perform the service.

More Information:

Independent Contractor Agreements: Worth The Paper They’re Printed On?VW Office Hours: Classifying Your Workers

Independent Director

An Independent Director is a member of the board of directors who is not associated with the company or its investors. Shareholders elect independent directors to provide an outside perspective.

Copy LinkIndication of Interest (IOI)

An Indication of Interest (IOI) is a preliminary letter sent by a buyer (sometimes an investor) to indicate a basic level of interest. It’s one step past “nice to meet you,” but well short of a Letter of Intent, and no where close to a binding document. See also Letter of Intent (LOI) or Memorandum of Understanding (MOU).

Copy LinkInformation Rights

Information Rights are investors’ agreed upon rights to receive certain financial records and other information from the company. Some rights will provide timelines for the company to provide certain financial reports and statements to the investor. Most information rights also allow investors the opportunity to view these records in person and discuss the information with the company’s officers.

Copy LinkInitial Coin Offering (ICO)

An Initial Coin Offering (ICO) is the IPO of the crypotcurreny world. An ICO is a fundraising technique where a company makes a portion of their cryptocurrency available for purchase by the public.

More Information:

Does your company’s ICO need to be registered with the SEC as a securities offering?Silicon Valley Review S5, Ep7: VCs vs. ICOs & Enforcing Contracts

Initial Public Offering (IPO)

An Initial Public Offering (IPO) is the first sale of a company’s stock on a public stock exchange. The company must comply with stringent SEC requirements to be eligible to be a publicly traded company. And, in most instances, a startup has been very successful if it reaches an initial public offering.

Copy LinkInside Round

An Inside Round is a round of financing where money is raised only from investors from previous rounds.

Copy LinkInsolvency

Insolvency is when a company cannot afford to pay its debts. If insolvency lasts for an extended period, creditors may bring an action to liquidate some of the company’s assets to repay the creditor, or alternatively, initiate a bankruptcy proceeding against the company.

Copy LinkInstitutional Investor

An Institutional Investor is an entity with large amounts of resources that invests significant amounts of money on behalf of individuals and companies. Institutional investors are typically investment companies, mutual funds, brokerages, and insurance companies.

Copy LinkIntegration

Integration, in regard to a sale of securities, is when the SEC determines that two of a company’s financing rounds were actually one large round for securities regulation purposes. The SEC then combines the two rounds, and depending on the amounts of money raised and who the investors were, the combined round may not fall under the securities exemptions that previous rounds did individually.

Copy LinkIntellectual Property

Intellectual property (IP) refers to creations of the mind, such as inventions, literary and artistic works, designs, symbols, names, and images. IP is protected in varying degrees by state, federal, and international laws. Common examples of IP include patents, trademarks, and copyrights.

More Information:

What’s the difference between a copyright, a patent, and a trademark?Does Your Idea Really Need an NDA?

Three Things #1

Interest

Interest is a fee paid at a particular rate for borrowing money from a lender.

Copy LinkInternal Rate of Return (IRR)

The Internal Rate of Return (IRR) is a metric used to determine whether an investment’s expected rate of return warrants an investment. This is determined by comparing the expected rate of return against alternative investments’ expected returns.

Copy LinkInvention Assignment

An Invention Assignment is an agreement where a founder or developer assigns to the company all of the intellectual property the founder or developer has created related to the company.

Copy LinkInvestment Adviser

An Investment Adviser is an individual or entity that is registered to provide investment advice about securities.

Copy LinkInvestment Banker

An Investment Banker is an entity or individual that underwrites companies’ security offerings. Investment bankers may also facilitate mergers and acquisitions.

Copy LinkInvestment Company Act

The Investment Company Act is legislation that regulates “investment companies,” or companies that invest and trade in securities and sell their own securities. The Act forces the companies to register with the SEC, lists specific requirements for the companies, and helps define the size, structure, and function of the companies.

Copy LinkInvestment Thesis

An Investment Thesis is the core set of investment principles for a fund. The principles set forth the industry and/or types of companies that the fund will invest in.

Example:

The VC fund’s investment thesis is to focus on SaaS based companies in secondary markets who are generating MRR of between $50k and $100k.

Copy LinkInvestor Rights Agreement (IRA)

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

Example:

The VC fund’s investment thesis is to focus on SaaS based companies in secondary markets who are generating MRR of between $50k and $100k.

Copy Link

Issue Price

The Issue Price is the price at which a company’s securities are sold.

Copy LinkIssued Shares are the amount of shares the company has sold or granted to shareholders.

Copy LinkIssuer

An Issuer is an entity that has “issued” or sold its securities.

Copy LinkIterating

Iterating is when a startup makes a minor change to its current business model in an attempt to capitalize on a similar or related market opportunity.

More Information:

Pivoting and Iterating in Startups are Different Things (David Cummings)THE "ITERATE FAST AND RELEASE OFTEN" PHILOSOPHY OF ENTREPRENEURSHIP (American Express Forum)

j

J-Curve

A J-Curve is a cash flow graph depicting returns vs. time. It demonstrates that at the beginning of a private equity fund cash flow and returns are going to be negative due to investing the funds, losses, and expenses. The upward curve of the J represents the time when the cash flow is increasing and results are trending upward.

Copy LinkJoinder Page

A Joinder Page is a signature page executed and joined to an agreement that was previously executed. The person executing the joinder page becomes bound by the agreement.

Copy LinkJoint Venture

A Joint Venture is an agreement between individuals or entities to complete some specific business task within a certain timeframe.

Copy LinkJumpstart Our Business Startups Act (JOBS Act)

The Jumpstart Our Business Startups Act (JOBS Act) is a law intended to encourage funding of United States small businesses and startups by easing securities regulations imposed by the SEC. The Act focuses on making it easier for startups to get capital financing, with the Crowdfunding Act playing a major part. The Crowdfunding Act allows just about any investor to invest in startups by removing 1930s era SEC regulations, and thus gives startups significantly greater access to capital.

More Information:

Title IV of the JOBS Act was recently passed. Read up on the effects these regulations will have on crowdfunding here.Crowdfunding

Junior Debt

Junior Debt is debt that is a lower priority to senior debt. Junior debt is also known as “subordinated debt.”

Copy Linkk

Key Employee

A Key Employee is an employee who plays a significant part in a startup’s success and has a major ownership and/or decision-making role in the business. Key employees are usually founders and C-level executives. Key employees may have certain restrictions or be tied to certain provisions in a later-stage financing round.

Example:

Our Series A round terms mandated that we get key man insurance on the founders and that each of the key employees grant a right of first refusal to Series A investors on transfer of their equity.

Copy LinkKey Man Insurance

Key Man Insurance is simply insurance taken out on the key persons (usually founders) of a business. In the event of a key person’s death, the insurance proceeds can be used to fund the business or to buy out the key person’s estate. This is oftentimes a requirement of venture funding.

Copy LinkKey Performance Indicator (KPI)

A key performance indicator is a measurable value that helps a startup measure key business metrics.

Example:

Our monthly investor update includes five KPIs – new pipeline customers, closed customers, MRR, ARR, and Burn Rate.

Copy LinkKISS Agreement

KISS is the acronym for “Keep It Simple Security,” which can be an alternative for either a debt or equity financing.

Copy Linkl

Lapsed Option

A Lapsed Option is an option that can no longer be exercised because some necessary condition has expired. Often stock options are granted but have a finite time period within which the options must be exercised. Once the finite period ends, the options that have not been exercised are said to “lapse.”

Example:

Once he left the startup, he only had 180 days to exercise his options before they lapsed.

Copy LinkLater-Stage Financing

Later-Stage Financing is a round that occurs once the startup has matured to an extent. Generally speaking, through the A or B round is early-stage financing. Everything after that is later-stage financing. If you were to really break it down, through A would be early, B & C would be mid-stage, and everything after would be later-stage. Later-stage is oftentimes pre-IPO. Contrast with Early-Stage Financing.

Copy LinkLaunch

A Launch is when a business kicks off, often by taking its app, technology, or site live. A Launch is a great time for a startup to draw attention to its product, attract talent to its team, and introduce itself to customers. Although the typical launch involves a one-time major event, there are many different types of launches.

Copy LinkLead Investor

A Lead Investor is the investor who is leading a startup’s financing round. The investor leads by (1) writing the biggest check, (2) negotiating the terms, or (3) both. Oftentimes, a round can not really start until a lead investor is identified.

Example:

We finally identified a lead investor for our $3M Series A round, so now the other smaller investors are ready to close.

Copy LinkLean Startup

A Lean Startup seeks to prove its business concept as quickly and inexpensively as possible by making a Minimum Viable Product (MVP) the top priority. Popularized by Eric Ries.

Copy LinkLegal Opinion

A Legal Opinion is a letter written by a lawyer providing the lawyer’s official opinion and judgment on a matter as an expert in the field. In the venture capital context, the lawyer is often asked to write an opinion on the validity of a company’s representations and warranties in financial documents.