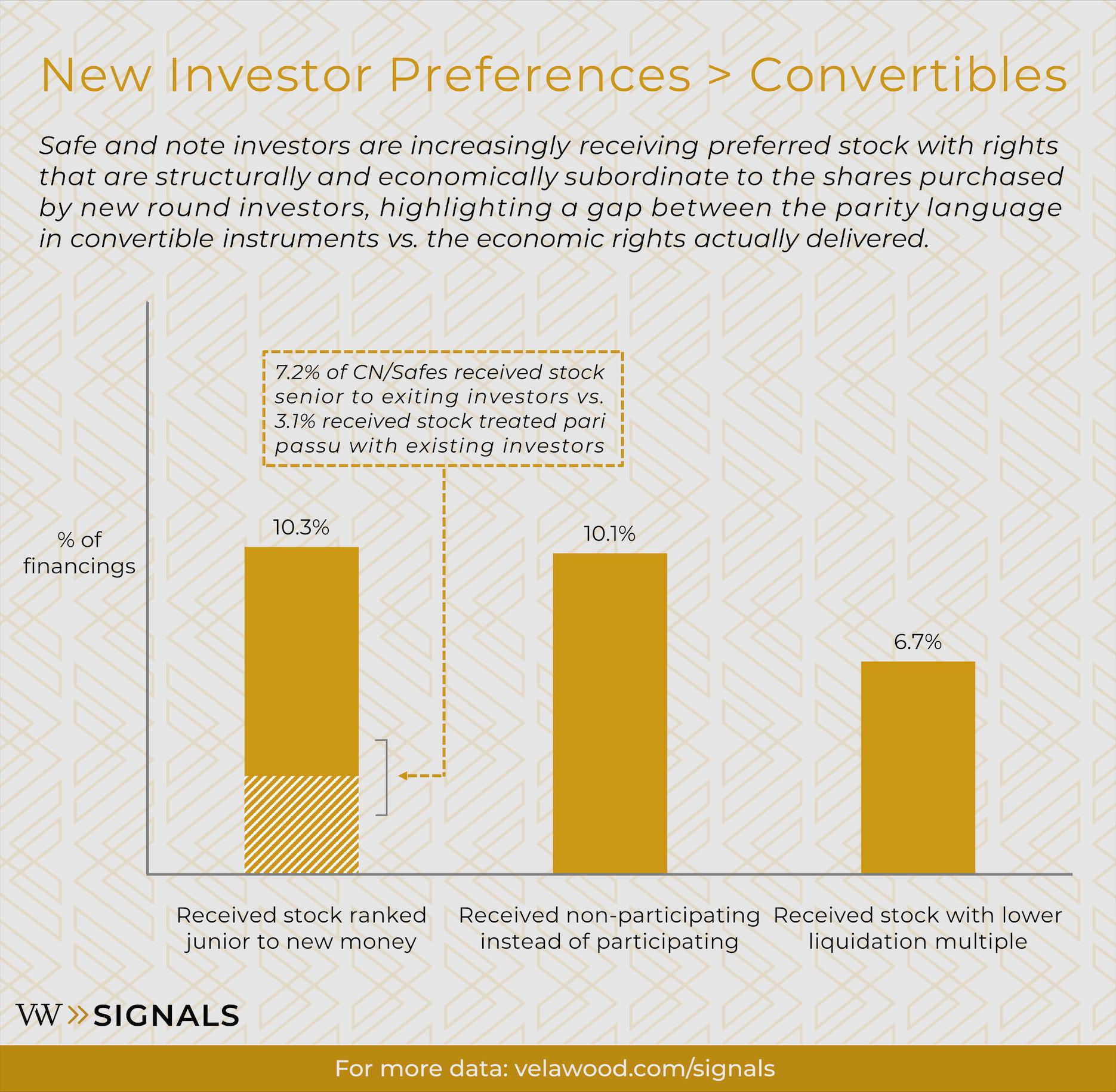

New Investor Terms Superior > Convertibles

How often do SAFEs and Notes convert into less favorable shares than those issued to new investors?

In a review of our last 50 equity rounds involving SAFEs and convertible notes, we found that in over 14% of financings, convertible holders received materially inferior terms relative to new money investors:

- 10.3% of rounds involved conversion into a junior liquidation class relative to new investors, including—

- 7.2% junior to new money but senior to prior preferred, yet

- 3.1% junior to new money and pari passu with prior preferred

- 10.1% received non-participating preferred while new money received participation rights

- 6.7% received a lower liquidation multiple than new investors

Why it matters:

Despite standard provisions in convertible instruments providing for conversion into the same (or substantially similar) series of preferred stock as issued in the next equity financing, lead investors in priced rounds frequently structure terms to allocate converted securities into “parallel” series that are economically subordinate. This practice reflects a growing divergence between the form of “next round” conversion rights and the substance of negotiated deal economics.

Founders and investors drafting convertible instruments should be mindful that “same terms” language is not self-executing—and is frequently overridden through the mechanics of deal structuring and board negotiation at the equity round. Note: Although the structure is usually proposed by lead investors, SAFE and Note holders actively consent to the conversion terms during the equity round closing.

Questions to consider:

- Founders: Does “same terms” still protect your earliest backers?

- Convertible Investors: Do you consider downside protections when signing SAFEs or Notes?

- Lead Investors: If you had to adjust one term for converting securities, would you choose priority, participation, or liquidation multiple?